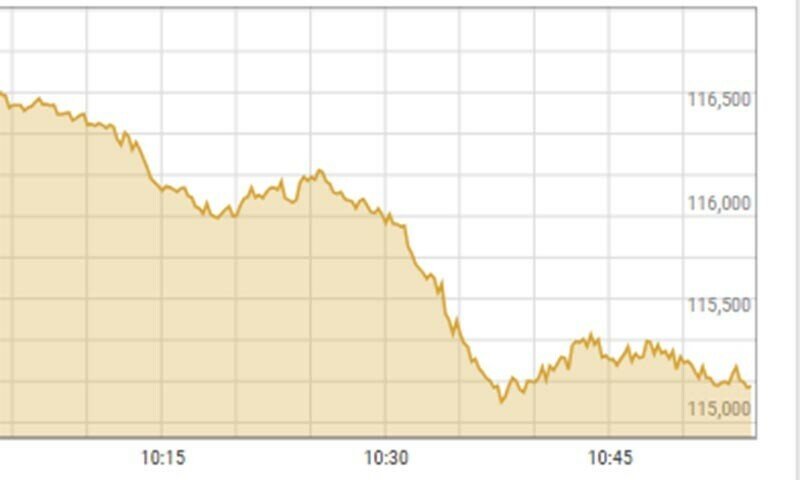

The bears continued their stampede on Tuesday on the trading floor as shares on the Pakistan Stock Exchange (PSX) fell over 700 points in intraday trade.

The benchmark KSE-100 index fell 768.80 points, or 0.66 percent, to 115,486.32 points at 11:04 a.m. from the previous close of 116,255.12.

Awais Ashraf, head of research at AKD Securities, said: “Investors are worried about the impact of the new government law that prevents non-filers from investing in stocks, mutual funds and debt instruments.”

However, he said they did not “foresee this having any impact as the stock markets are well regulated in Pakistan, thanks to the FATF.” [Financial Action Task Force] compliance”.

Additionally, he highlighted that this was “a good time to get into equities as interest rates are expected to fall to single digits” due to a strong external account.

“Falling alternative investment returns are expected to make equities the preferred asset class in 2025,” he added.

Yousuf M. Farooq, director of research at Chase Securities, attributed the momentum to the market going through a “profit-taking and correction phase after a significant rally.”

“These moves are a normal part of market cycles after substantial gains,” he said. “However, investor sentiment remains cautious amid reports of rising circular gas debt and higher tariffs for captive power plants.”

The International Monetary Fund (IMF) has called on the government to impose a substantial tax on gas supplies to industrial captive power plants (CPPs) to eliminate any cost benefits between grid power and their internal electricity generation.

Under the $7 billion Expanded Fund Facility (EFF) signed in September last year, Pakistan has to meet one of the major structural benchmarks that required gas disconnections to CPPs by the end of January 2025 to qualify for disbursement of the second of seven $1 funds. tranches of billions in March. The two sides will meet for the first biannual review in the second half of February.

According to Farooq, “the economy is transitioning towards dependence on the national grid, although the full impact of this shift remains uncertain.

“Captive power plants have historically been reliable, well-paying customers for government gas companies. Its transition to the grid should eventually benefit all grid users by improving efficiency and utilization,” he said.

Furthermore, he highlighted that interest rates remained another focal point for market participants.

“While we are optimistic that interest rates could reach single digits over the next year, most participants believe rates will bottom out at around 11 percent, suggesting elevated rates could become the new normal,” he explained.

In addition, he explained that inflation was “expected to increase after March and remain high, which could limit the performance of the stock market in the short term.”

“Historically, inflation has remained low in Pakistan in periods with little or no currency devaluation,” he said.

Against this backdrop, Farooq advised retail investors to look beyond short-term market fluctuations.

“Instead, they should focus on adding small, consistent contributions to their long-term diversified portfolios each month,” he said.

Stocks turned bearish yesterday as the flow of news on political and economic fronts made investors nervous, leading to earnings selling, forcing the benchmark KSE 100 index to close in the red.

One analyst attributed the boost to political uncertainty, and the International Monetary Fund’s (IMF) strict taxes on captive industrial power plants led to institutional profit-taking.

More to follow