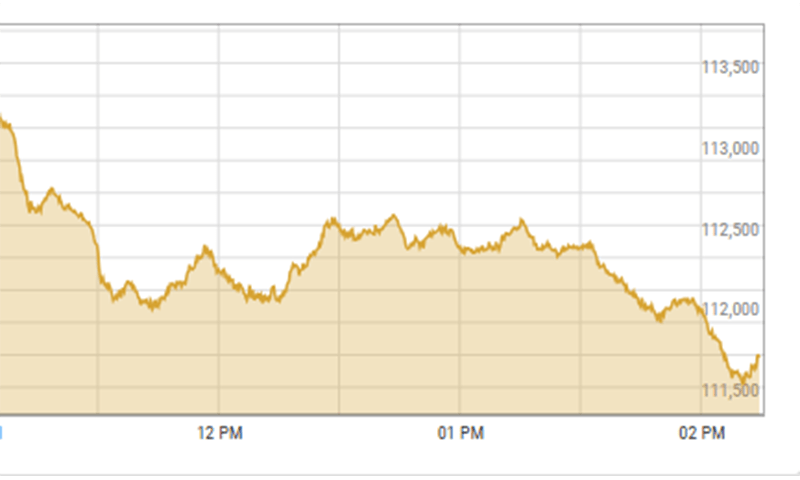

Bears held his control over the Pakistan Stock Exchange (PSX) on Tuesday when the shares lost almost 1,500 points.

The KSE-100 reference index decreased by 1,489.96 points, or 1.31 percent, to close at 112,030.36 points from the previous closure of 113,520.32.

Yousuf M. Farooq, research director of Chase Securities, said: “The market was opened under pressure today after a news report yesterday in which the Petroleum Minister declared that RS82 billion of the profits of state companies would be used to protect consumers from increasing gas costs. “

He said the comments “expressed concerns among market participants that the government can use state companies (SOE) again to appease the public, echoing past practices.”

However, he believed “that such action may not be legally feasible.”

In addition, Farooq said the market seemed to be “taking a respite” after witnessing a significant demonstration from October to December last year, adding that such corrections were normal.

“However, the comments of the Petroleum Minister have added to the precaution of investors,” he added.

Awais Ashraf, Director Investigation at AKD Securities, said investors were concerned about the Trump administration decision to suspend the help provided by the United States to Pakistan.

Last week, the United States, the world’s largest donor, practically froze all foreign aid, making exceptions only for emergency foods and military funds for Israel and Egypt.

The Secretary of State, Marco Rubio, sent an internal memorandum days after President Donald Trump assumed the position of promising a policy of “first America” of restriction of assistance closely abroad.

“However, this problem is not exclusive to Pakistan, but it extends to all countries,” said Ashraf, added that this was not going to an “impact on our payment balance, such as, unlike the past, subsidies Americans now represent only a small fraction of external funds for FY25 ”.

He stressed that the total subsidies assigned for fiscal year 2025 (FY25) amounted to only $ 176 million, which represented 1 percent of the total external financing target of $ 19.34 billion.

“Interestingly, Pakistan received $ 38.3 million in subsidies from the USA.

He added: “In addition, there are no assignments for bilateral loans from the USA in fiscal year 2015”.

Meanwhile, Mohammed Sohail, Executive Director of Topine Securities, attributed the bearish impulse to January reinvestment and the results lower than expected press the market.

Yesterday, despite the strong anticipation of a sixth consecutive cut in the interest rate in the monetary policy review meeting, the actions had witnessed a roller mountain session mainly due to political instability, an increase in gas tariffs and disappointing corporate results.

It was observed that the decision of the Economic Coordination Committee to increase the gas rate by almost 17 percent for captive electric power plants was the key depressant. This movement caused a strong reaction from export -oriented players, especially the textile sector, saying that this movement would harm the country’s export competitiveness in regional and international markets.

More to follow