Mumbai: the superstar Shah Rukh Khan won a significant victory like the Income Tax Court of Appeal (ITAT) ruled in his favor, annulling Revaluation procedures and order initiated by the tax authorities For the Financial Year 2011-12.

Against an income of RS 83.42 million rupees declared by the actor in his income tax yield (IT), the tax officer denied his claims for foreign tax credit (for taxes paid in the United Kingdom) and reassessed income as RS 84.17 million rupees. Such reevaluation was carried out beyond four years since the end of the year of relevant evaluation (2012-13).

The Itat Bank said the reassessment of the case by the Income Tax Department was not legally justified, marking a crucial victory for the actor in his prolonged battle over foreign tax credit claims.

The litigation related to Khan’s remuneration taxes for the movie ‘Ra One’. According to the agreement between the actor and the entertainments of the red chiles (a film production and distribution founded by Khan), 70% of the filming of the film should take place in the United Kingdom and, therefore, 70% of the income would accumulate abroad (which would be subject to taxes of the United Kingdom, including tax withholding). The remuneration of the actor, in this regard, was enrupted through Winford Production, an entity of the United Kingdom. The tax authorities argued that said payment agreement caused a loss of income to India. The IT officer denied the claim of the foreign tax credit actor, which was made in his original performance.

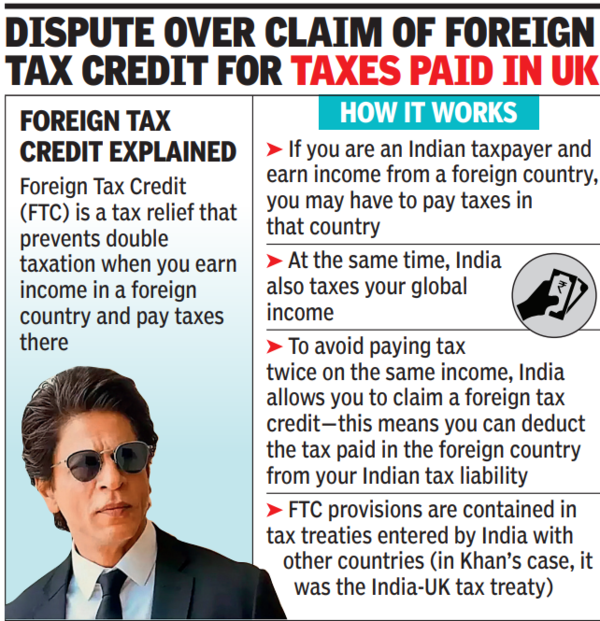

An Indian resident taxpayer is subject to taxes in India on his global income. In simple terms, the foreign tax credit provisions contained in fiscal treaties allow an Indian taxpayer to deduce taxes paid in the foreign country of its tax obligation of India. This avoids the double taxes of the same income.

In a detailed order, the ITAT bank composed of Sandeep Singh Karhail and Girish Agrawal, ruled that the reevaluation procedures were not valid. The court indicated that the evaluating officer had not demonstrated any new and tangible tangible material that guarantees a reevaluation beyond the legal period of four years. In addition, he observed that the problem in dispute had already been examined during the initial evaluation of the scrutiny of the case.

Citing multiple judicial precedents, the court emphasized that the reevaluation under section 147 can be done after the expiration of four years from the end of the year of relevant evaluation, only if certain conditions were met. For example, if the income had escaped the evaluation because the taxpayer does not submit a declaration of IT or responds to a notice. Or, if the tax taxpayer could not have revealed all material facts during the original evaluation. The court found no evidence of such failure by Khan.

The Itat Bank concluded that the reevaluation procedures were bad in the law in more than one position and were not in accordance with the provisions of section 147, and annulled the same. Tax experts believe that the trial strengthens the position of Indian taxpayers with profits abroad, which reaffirms that reevaluations cannot be arbitrarily initiated without sufficient reasons.