Actions futures fell early Monday to begin a new negotiation month, since investors weighed new US tariffs on the assets of key commercial partners and their potential impact on the economy and corporate profits.

Futures linked to the Dow Jones industrial average slid 546 points, or 1.22%. Futures S&P 500 fell 1.4%, while future Nasdaq-100 lost 1.7%.

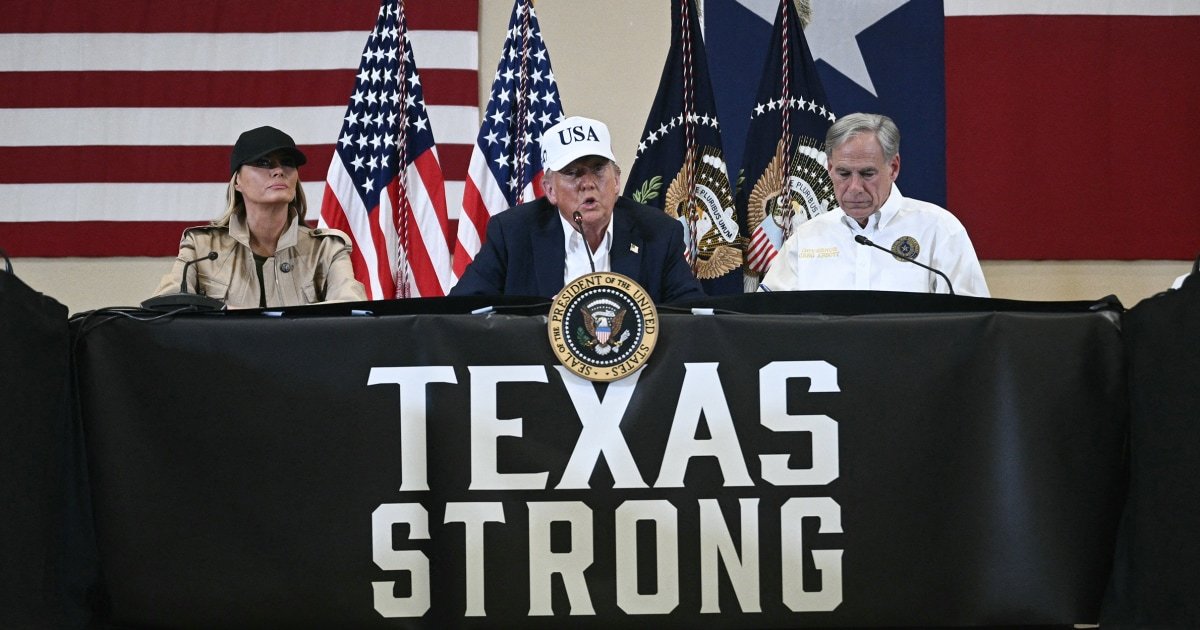

President Donald Trump slapped a 25% tariff on the goods of Mexico and Canada on Saturday. He also placed a 10% tax in China imports. The United States ago around $ 1.6 billion in business with the three countries.

Canada responded with its own retaliation rates, while Mexico said it would explore taxes on US imports. Meanwhile, the Chinese government said it would file a demand before the World Trade Organization.

“Markets may now need to take the rest of the Trump tariff agend The United States policy and policy research, Tobin Marcus said in a note.

Petroleum and gasoline futures were negotiated higher after American tariffs. The US dollar also advanced.

Merchants are also looking at the largest week for the profits of the fourth quarter, which have become increasingly important to determine the market status as the rates refer to the ramp and artificial intelligence stock . More than 120 companies in the S&P 500 will inform their results, including the technological names Alphabet, Amazon and Palantir, as well as consumer giants, including Walt Disney and Mondelez.

The non -agricultural payroll of January will also come out on Friday, adding color to the employment image so far this year. Economists surveyed by Dow Jones expect 175,000 jobs to be added last month. It is predicted that the unemployment rate has remained unchanged by 4.1%.

Stocks leave a few volatile weeks. The three main indexes of the United States ended Friday’s negotiation session in El Red, but the merchants still closed the first month of the year with profits. The S&P 500 won 2.7% and the Nasdaq compound with technological weight added 1.6% in January, while the Dow Jones industrial average exceeded during the period, jumping 4.7%.