Nueva Delhi: The Delhi government suffered a loss of income of more than 2,000 million rupees in the implementation of the Special Tax Policy of Delhi 2021-22, the Comptroller and the General Auditor (Cag) revealed in a report that was presented at the Delhi Assembly on Tuesday. The policy was withdrawn after nine months after the record of a case by CBI in July 2022 to investigate alleged irregularities in its formulation and implementation.

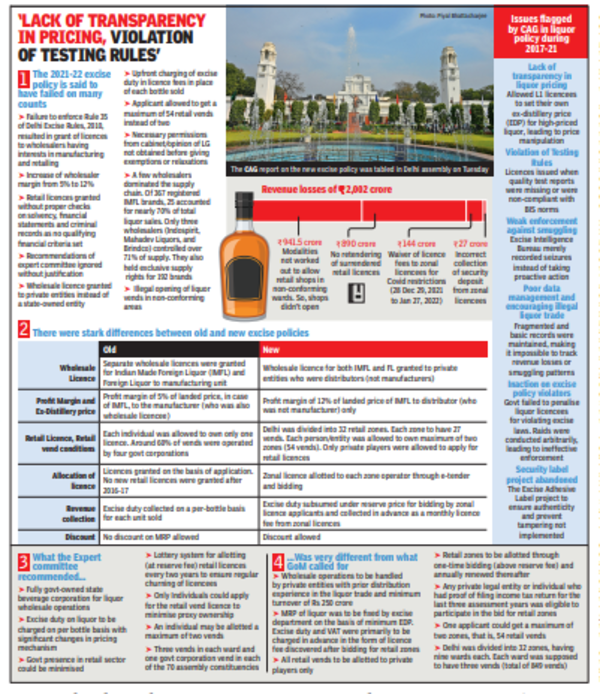

The Federal Auditor stressed that the recommendations of an expert committee, formed by the Government to identify lagoons in the previous special tax policy and suggested changes for the formation of a new special tax policy, were ignored without any justification. The new policy had inherent design problems that increased the risk of monopolization and poster formation.

The CBI case and an related investment of ED in alleged money laundering positions shot at a political leader between BJP and the AAP government in Delhi. The investigating agencies arrested several people in the case, including the then principal minister, Arvind Kejriwal, his deputy, Manish sisodyand the deputy of Rajya Sabha Sanjay Singh. The three are currently on bail.

Cag evaluated the regulation and liquor supply of the Delhi government in the capital of 2017-18 to 2020-21 financial years. According to the reports, the report was sent to the LG and Delhi government almost 10 months ago, but did not appear at the Assembly. Newly chosen cm Rekha Gupta He presented the report, which is said to be one of the 14 earrings with the Delhi government, Tuesday.

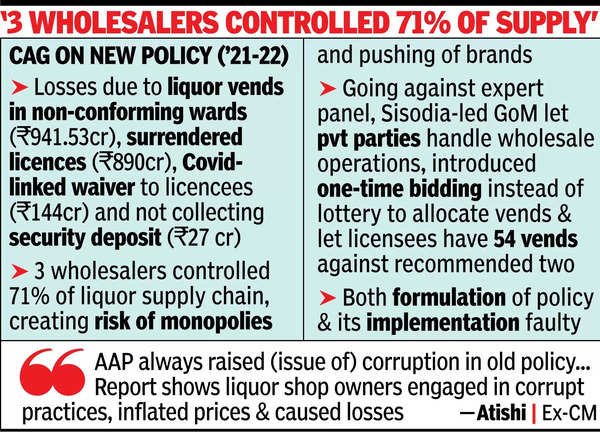

According to CAG, Delhi’s Special Tax Department claimed a loss of income for a sum of RS 941.53 million rupees, saying that no appropriate permits were taken to open the liquor liquor in non -compliant municipal rooms, while RS 890.15 million Bachelorians delivered their permits long before the policy was removed, but a re-tender could not be made. He added that there was a loss of RS 144 million rupees due to the “irregular concession of exemption” to licensees due to restrictions related to COVID and closure of stores for a month from December 28, 2021 until January 27, 2022 , while RS 27 Crore was the deficit of the security deposit raised by the zonal licensees.

The report establishes that the Master Delhi-2021 plan prohibited the opening of liquor sales in non-conforming areas, but the Special Tax Policy of Delhi 2021-22 ordered the opening of at least two retail sales in each room. “The Special Tax Department did not take appropriate measures to resolve modalities for the advantages proposed in non -compliant areas and the initial tender floated on June 28, 2021, without receiving comments from DDA and MCD,” he said.

“The audit said that due to a series of problems ranging from a weak policy frame to the poor implementation of the policy … there was a cumulative loss of approximately 2,002.68 million rupees,” CAG said.

The report says that a group of ministers (GOM), headed by the then vice president of CM and the Minister of Special Taxes, Manish Sisodia, changed several recommendations from the Committee of Experts formed to formulate the policy and allowed the private parties to handle the operations of wholesale liquor, they introduced time for a while. PIDE instead of a lottery system to assign advantages and let licensing have 54 advantages against both recommended entity. He added that certain decisions with implications of income (relaxation of the mandatory coercive action against deformation licensees, the exemption in the license rate, the reimbursement of the money deposit in case of the airport area and the correction in formulas to calculate the Maximum retail price of foreign liquor). without having the mandatory approval of the Cabinet and the opinion of Lieutenant Governor.

The auditor pointed out that the policy led to the risks of the monopolies and the impulse of the brand by allowing an “exclusive disposition” between some wholesalers and manufacturers and letting the distributors dominate the liquor supply chain. According to the report, only three distributors controlled more than 71% of the total liquor supply chain in capital and practically decided what brand would be successful or fail.

The report mentioned that of 367 brands of registered foreign liquors, 25 represented almost 70% of the total liqueur sales in Delhi and very popular very popular formed most of the sales volume, which pointed to the formation of a poster.

“The policy demanded an exclusive agreement between a manufacturer and wholesalers, which led to the entire supply of all brands of a particular manufacturer controlled by a single wholesaler. This becomes particularly relevant taking into account the fact that 367 IMFL brands were recorded in Delhi, ”said the report.

This, the CAG mentioned, led to limit the total number of graduates and increase the risk of monopolization and poster training. According to the new special tax policy, wholesale licenses were granted for the supply of IMFL and FL to 14 commercial entities, while they were granted to 77 IMFL manufacturers and 24 FL suppliers in the previous policy (2020-21).

“Similarly, for the purposes of retail sales, Delhi was divided into 32 zones (containing 849 expectations) whose licenses were granted to 22 entities through the tender, while 377 retail sales were directed by four government corporations and 262 Retail expectations were assigned to private individuals previously, “the report said.

He added that the GOM had mentioned in its report that the entire retail market for liquors under the old special tax regime was controlled by some great players through a fraudulent proxy model, but the new policy, instead of eliminating this anomaly, The recommended distribution of retail licenses in areas where an entity or person could obtain up to 54 advantages (in two areas, the maximum can be assigned).

According to the report, licenses had to establish laboratories before the license is granted, but the Special Tax Department issued related guidelines only one week before the new policy was implemented. “The essential pre-conditions to establish laboratories to ensure that the Special Tax Department has not fulfilled the quality of the liquor provided by the Tax Department due to the delay in the issuance of guidelines. The licensees were allowed an extension of two months initially to establish the laboratory, although there was no disposition for this in politics. An additional extension was granted until March 31, 2022 due to the COVID-19 pandemic. Even after this extension, they were established only in 19 of 62 stores. Lot tests did not even start in these laboratories, ”said the report.

Cag said that the department was supposed to constitute special equipment to collect samples of linked warehouses, retail advantages, hotels, clubs and restaurants in all brands and publish their reports on the website. No response was provided despite multiple reminders and it could not be verified if such special teams were ever constituted, he said.

“Several fundamental changes were made in the special tax policy for 2021-22 related to the tax and the collection of special taxes, the administration of the liquor supply chain and the coverage of retail operations. The real policy contained provisions that disagree with the underlying objectives for the change in the policy and report of the expert committee, ”said the CAG report.

“Responsibility and responsibility must be set for the observed lapses and the application mechanism must be strengthened,” he concluded.