Can smart purchasing really help Canada fend off economic threats from the United States?

If you believe the rhetoric of some political leaders, every little bit helps, especially if consumers pay more attention to labels.

“When you look at ‘Made in Canada’ or ‘Made in Ontario,’ buy them,” said Ontario Premier Doug Ford, who is about to call an early election in part, he says, to shore up his efforts against imminent threat of US tariffs.

“Be sure to send a message to the big box retailers. Costco, Sebeys, Walmart, Metro and Loblaws. Buy Canadian products.”

Prime Minister Justin Trudeau suggested that substituting Canadian-made products could help mitigate the impact of wide-ranging tariffs that U.S. President Donald Trump has repeatedly threatened.

“Making Canadian consumers have alternatives … is part of how we make sure Canadians don’t have undue costs around tariffs,” Trudeau said this week.

US President Donald Trump, speaking by video to people gathered at the World Economic Forum in Davos, Switzerland, argued that other countries, including Canada, are taking advantage of the United States. He also repeated claims that the United States doesn’t need anything from Canada.

But observers say the reality of the country’s current economy is that it’s not easy to find Canadian products in a variety of sectors.

“We don’t do a lot of good consumer processing in Canada,” said Torsten Søcthing Jaccard, an assistant professor at the University of British Columbia’s Vancouver School of Economics. “We produce a lot of the raw inputs.”

Daniel Trefler, an economist and professor at the University of Toronto’s Rotman School of Management, doubts such an approach will yield measurable results.

“The focus on consumer-facing goods will get us nowhere,” he said in an email.

Complex economy

Domestic industries would welcome any potential increase in business from a push to buy Canadian.

But even manufacturers admit that the complex, modern Canadian economy operates differently than it did decades ago, in the days before free trade, and that such an effort could only go so far in reducing the pain that tariffs would bring.

“Due to the size of our market, Canadians buying Canadian-made products … won’t make up for potential losses if things are restricted in the U.S. market,” said Dennis Darby, president and CEO of Canadian Manufacturers and Exporters, whose organization organization Represents 2,500 manufacturers throughout the country.

It easily lists a number of products that are made in Canada (various foods and beverages, pet foods, cosmetics, furniture, and more), but says that doesn’t mean you can get a domestically produced version of everything.

“You can’t buy a Canadian-made dishwasher, because we don’t make dishwashers anymore,” Darby said, noting that domestic manufacturers are more likely to produce parts for such products that are prepared for the state market.

Consumers are also aware of how difficult it can be to find Canadian-made products in certain categories.

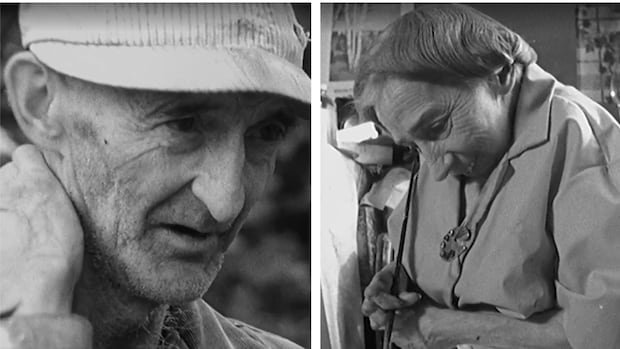

For Deb Kroeger, a retiree from the Muskoka region of Ontario, one example that comes to mind is clothing.

“On a broad scale there is not so much [Canadian-made stock]”Kroeger said, noting that when his now-grown son was young, he was able to buy him a Chicago Bulls sports jacket that had been made in Quebec.

UBC’s Jaccard said trying to determine the Canadian content of a particular good is “not that simple” today, amid a highly integrated North American economy that often sees the involvement of companies on both sides of the border to carry products to consumers.

What about groceries?

The potential mid-winter arrival of U.S. tariffs also means Canada is not in a position to get the same type of homegrown produce available at other times of the year.

So buying Canadian might not be an option, depending on what you’re looking for, and that’s aside from any price considerations.

“I know in January you can’t get a radish grown in North Bay,” said Glen Huard, a recent retiree from that northern Ontario city, who sees the tariff threat as a “wake-up call” for the country.

Ron Lemaire, president of the Canadian Produce Marketing Association, points out that although berries are also not growing outdoors this time of year, Canadians do not restrict their fruit and vegetable intake to what grows here.

“We can’t grow citrus in Canada,” for example, Lemaire said, so Canada relies on produce imports to meet the broad demand for various fruits and vegetables across the country.

He says that while Canadians are “very fond of domestic products,” the costs of those goods are ultimately what drives decisions about what to buy.

Huard agrees.

“If a package of carrots tripled in price, then we might go to a different vegetable,” he said.

A boost for some?

Huard would like to see more effort to highlight the available stock of Canadian products in stores.

“I don’t think it needs to be too elaborate,” he said, suggesting that having a signature maple leaf sticker would be a simple method of achieving this.

If a “buy Canada” movement were to emerge, it would likely have some impact on some companies’ bottom lines.

Raina Husseini, senior vice president of print at Indigo Books & Music Inc., says the bookseller has long promoted the work of Canadian authors and publishers, and is aware that the current political climate may increase interest in these products.

“The importance of buying local and Canadian was really highlighted during the Covid Peak years and we are anticipating that may be again with the US tariffs being discussed,” Husseini told CBC News in an emailed statement.

Furniture retailer Urban Barn, which operates more than 50 stores nationwide, has come to a similar conclusion.

“If tariffs are imposed, we anticipate that Canadians will choose to shop at Canadian retailers, including ourselves, compared to our U.S. competition,” Ainslie Fincham, the company’s chief marketing officer, said by email.

Two other large Canadian retailers did not indicate any planned changes to their business despite the tariff threat.

Richia McCutcheon, public relations manager for home hardware, says the retailer remains focused on its customers’ needs “regardless of the political context.” However, he highlighted the chain’s Ontario-produced Beautitone paint products as an ongoing “key focus.”

Discount retailer Giant Tiger declined to detail its business strategy but said it has long focused on “offering products at the lowest possible price.” As such, it works with “a wide variety of Canadian supplier partners and suppliers” to deliver on that promise.