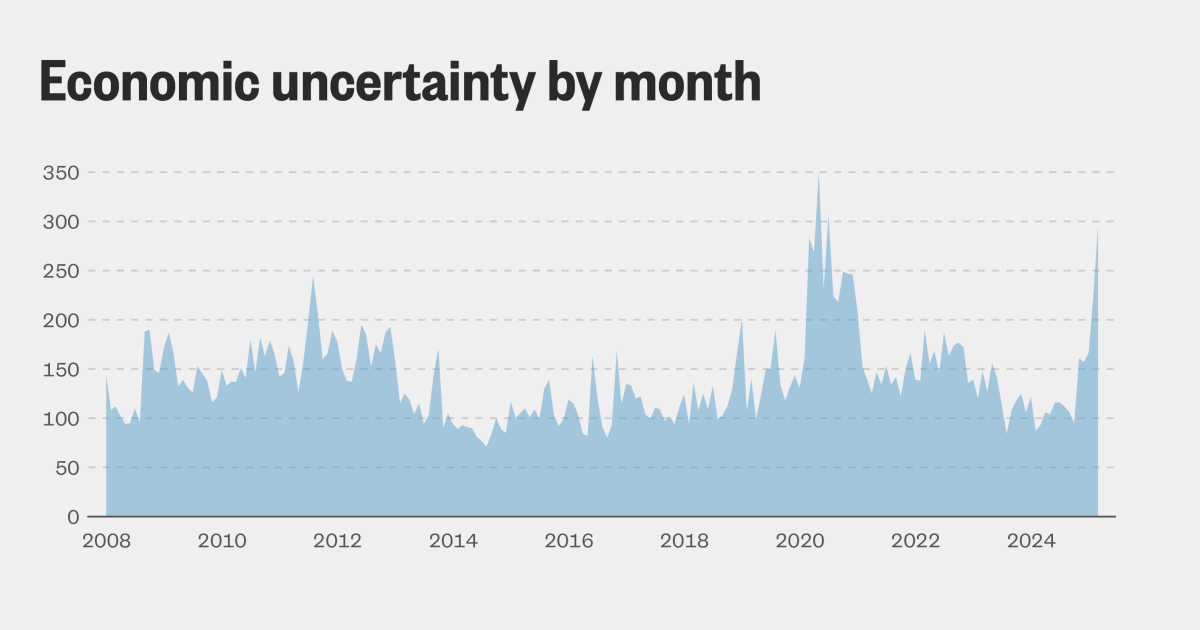

Kevin L. Klieen, St. Louis economist Federal Reserve, He pointed out that the change in the uncertainty of past spring to this spring is the strongest increase in almost 40 years.

“It is a historically unprecedented increase,” Kliesen said.

Instability makes it more difficult for companies and consumers to make decisions, and it can be a scene for recessions. “Companies will delay investment in response to greater uncertainty,” Kliesen said. “Consumers who face greater uncertainty about labor perspectives could reduce spending.”

Menzie Chinn, Professor of Public Affairs and Economics at the University of Wisconsin, said: “People are to the fullest.”

To show how uncertainty develops, Chinn gave an example of potential housing buyers: reducing interest rates could attract them, but cares about a great fall in housing prices during the next year, of the type that could arise from a recession, it could scare them.

“It’s better news, but it was discarded by this bad uncertainty,” Chinn said.

Uncertainty extends to the bond market: government bonds are sold more than they are bought, even when sour actions, mocking historical trends.

Traditionally seen as a safe port, bonds tend to be bought by investors when the markets are at the limit. That is not the case today, with 10 -year treasure yields that increase above 4.5%.