MUMBAI: India’s market capitalization fell below the $5 trillion mark for the first time in more than seven months, thanks to a falling market and a weakening rupee. India’s market capitalization was just over $5.7 trillion at its peak on September 27, 2024. On Monday, it closed at $4.8 trillion.

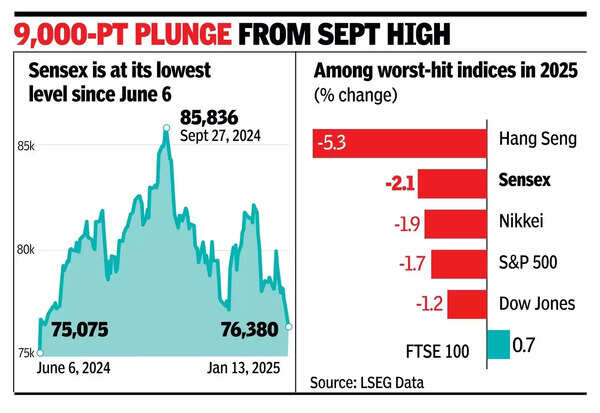

Investor sentiment in Dalal Street was hit by a weak US market close on Friday night as strong US employment data earlier in the day further dimmed the chances of aggressive rate cuts in the coming months in the world’s largest economy. The day’s sell-off took 1,049 points off the sensex, which closed at 76,330 points, a closing low of over 7 months.

“Global markets witnessed a significant sell-off, triggering a similar response in domestic markets due to strong US payroll data suggesting fewer rate cuts in 2025,” said Vinod Nair of Geojit Financial Services. “This has strengthened the dollar, raised bond yields and made emerging markets less attractive. Recent GDP declines and slowing earnings amid higher valuations are weighing heavily on market sentiment. (internal)”.

On Monday, mid-cap and small-cap stocks witnessed even stronger selling than blue-chip stocks. The combined effect led to a total loss of investor wealth worth about Rs 12.6 lakh crore, with the BSE’s market capitalization now at Rs 417 lakh crore. The day’s selling was led by foreign funds which recorded a net outflow of nearly Rs 4,900 crore, while domestic funds were net buyers of Rs 8,067 crore.

Rising crude oil prices after the US president extended the ban on oil from Russia also hit investor sentiment on Dalal Street as the move further weakened the rupee and could eventually lead to an increase in inflation. “Rising crude oil prices would raise concerns about a rise in domestic inflation, which could further delay any hopes of rate cut by the RBI in the short to medium term,” said Prashanth Tapse of Mehta Equities.

In Monday’s market, of the 30 sensex stocks, 26 ended in the red, BSE data showed. HDFC Bank, ICICI Bank and Zomato contributed the most to the day’s decline. Higher closes in TCS, Axis Bank, HUL and IndusInd Bank cushioned the decline, but only marginally. In the short term, among other things, the rupee-dollar exchange rate, trading trend of foreign funds and crude oil prices will decide the market trend, traders said.