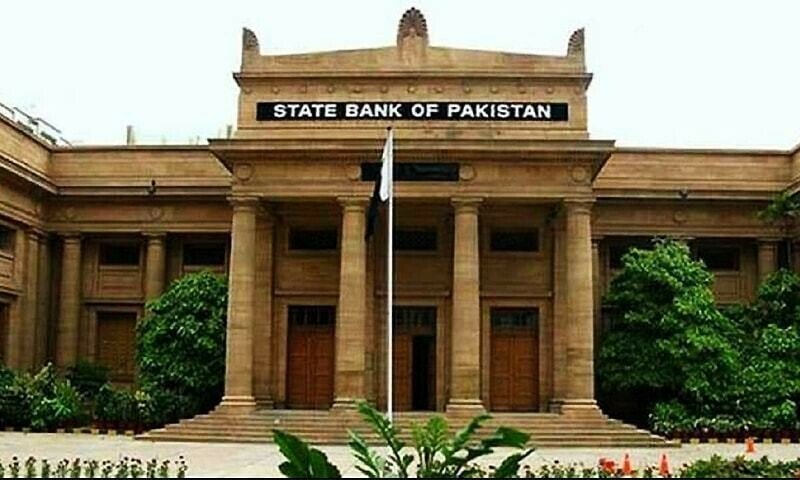

The State Bank of Pakistan (SBP) reduced the policy rate on Monday to 11 percent, in the middle of the commercial and industrial sectors that advocate a significant cut.

The policy rate of the Central Bank, after being reduced by 1,000bps from 22 percent since June 2024 in six intervals, was previously at 12 percent.

April inflation remained at a minimum of 0.3pc, largely due to a high base a year ago. The reduction is also mainly attributed to lower prices of basic foods such as wheat and its derivatives, onions, potatoes and certain pulses, as well as a cut in electricity and fuel charges. These items have a significant weight in the inflation basket, the consumer price index (CPI), which means that lower changes in the price can greatly influence the general rate.

According to a notification issued by the SBP today, the Monetary Policy Committee (MPC) decided to reduce the interest rate, noting that inflation in April turned out to be less than expected, mainly due to a fall in perishable food prices and electricity and fuel charges.

According to the statement, central inflation decreased in April, mainly reflecting the favorable base effect amid moderate demand conditions.

“In general, the MPC evaluated that the inflation perspective has improved even more in relation to the previous evaluation,” said the statement.

The committee saw that the greatest global uncertainty around commercial tariffs and geopolitical developments could raise challenges for the economy.

“In this context, the MPC emphasized the importance of maintaining a measure of measured monetary policy,” he said.

The committee also observed key developments since the last meeting.

He said that the growth of the provisional real GDP for Q2-FY25 was informed to 1.7 percent year-on-year, while the growth of the first quarter was checked up to 1.3pc from 0.9pc.

“Secondly, the current account registered a considerable surplus of $ 1.2 billion in March, mainly due to record workers,” he said.

He said that the surplus and the purchases of SBP currencies partially damping the impact of large debt payments in progress on SBP currency reserves.

He also said that recent surveys suggested an additional improvement in consumer and commercial feelings, adding that the tax collection deficit has continued to expand.

“Global uncertainty, particularly around tariffs, has led the IMF to abruptly degrade its 2025 and 2026 growth projections for advanced and emerging economies,” said the statement, adding that tariff uncertainty also caused greater volatility of the financial market and a strong decrease in global oil prices.

“Taking into account the developments and risks, the MPC saw that the real policy rate remains properly positive to stabilize inflation in the target range of 5pc to 7pc, while ensuring that the economy grows sustainably,” he said.

Separately, the statement said that the main inflation, which continues its bassist trend, fell to 0.3pc and/and in April, mainly driven by food and energy prices.

“A strong decrease in the prices of wheat and allied products, moderation in world prices of basic products and the downward adjustment in electric tariffs were the main drivers of this ease in food and energy prices,” the statement said.

“These factors also contributed to moderation in the inflation expectations of consumers,” he said.

In addition, the inflation of the nucleus, after remaining sticky around 9 percent in recent months, decreased to 8.0pc and/and in April, he added.

The statement said that in the future, the Committee anticipated inflation to gradually increase in the coming months and stabilize within the target range of 5pc to 7pc.

“However, this perspective is subject to upward risks and the decline emanating from volatility in wheat and other food prices, time and magnitude of energy prices adjustments, possible interruptions of the global supply chain and an uncertain perspective of the prices of basic products.”

Previously, he pointed out that despite a long -term decrease in inflation and real interest rates greater than 11 %, opinions on the probable decision of the Central Bank on the policy rate were divided, with the commercial and industrial sectors that advocate a significant cut.

The researchers had conducted surveys to measure the feeling of the market, but inflation of 0.3 percent in April has caused the division between those who trusted that there would be no interest rate changes.

However, many experts believed that the SBP would reduce the rate by 50 bp. Some had also found reasons for a probable status quo, since they feel that the war situation between India and Pakistan has created uncertainty that prices can increase.

This situation can force the Central Bank to adopt a cautious approach to sudden clashes with greater inflation.

The MPC of the SBP met today to establish the key interest rate for the next two months. In March, the Central Bank delivered a surprise by leaving its policy rate without changes in the last review, disappointing the business community.