Ray Anholt of Victoria recently celebrated his 90th birthday, but says there was little to celebrate: Falling victim to one of the largest bank investigator scams ever reported in Canada, he was left virtually penniless.

Over six months last year, Anholt lost his life savings: nearly $1.7 million.

The scam involved fake bank employees, fake official letters from various government and political bodies, piles of cash, massive bank drafts, gold bars and couriers, but the most incredible part of the complicated ordeal is that two major banks allowed a vulnerable senior to empty his accounts despite red flags, Anholt’s daughter says.

“They saw this 89-year-old man take out every last cent” Jill Anholt told Go Public, her jaw clenching with anger.

and while Good heavens The loss was enormous, he has a lot of company.

- Do you have a story you want investigated? Contact Erica and the Go Public team at gopublic@cbc.ca

Last year alone, Canadians lost more than $643 million to bank fraud, an increase of nearly 300 per cent from 2020. As scams become increasingly sophisticated, experts say our financial institutions are lagging behind other countries with better protections.

“This has been a rampant problem for years and we have seen nothing but small steps forward,” said Democracy Watch co-founder and bank accountability advocate Duff Conacher.

Neither CIBC nor Royal Bank – where Ray was a client and agreed to an interview. Both banks said in statements that have robust measures in place to protect and alert customers when fraud is suspected.

the scam

In June 2024, Ray’s phone rang; the call screen showed that the number was from CIBC, but it was actually a scammer.

The caller said he worked in the bank’s fraud department and He needed Ray’s help with a major national money laundering investigation.

He ordered her to withdraw money from her accounts and told her that a courier would collect the money from her apartment and that she would be kept safe until the investigation was concluded.

The family of an 89-year-old man is wondering why neither RBC nor CIBC stopped him from using up $1.7 million of his life savings, despite promises to help keep seniors safe from fraud.

The scammer also said it was imperative that Ray not tell anyone as it could jeopardize the investigation.

“They said, ‘We want to make sure you don’t lose your life savings,’” Ray said. “So I followed him.”

His daughter says he also complied because people in supposedly powerful positions asked for his cooperation.

“He and his generation believe in authority,” Jill said. “If someone in authority asks them to do something, they feel like they have to do it.”

CIBC allows withdrawals

Ray began making cash withdrawals at various CIBC branches, where he had been a customer for decades.

At one point, a branch manager questioned his activity and froze his online banking account and his ability to withdraw money from an ATM. But Ray could still withdraw money in person, and he continued to do so.

Eventually, the manager of his central Victoria branch wrote a letter to Ray, stating that the activities on his account were “unusual” and that, in the bank’s experience, transactions requested by third parties “have no legitimate purpose,” but stopped short of clearly warning that he was likely involved in a scam.

Upon learning that CIBC was raising concerns, the scammers concocted a story and ordered Ray to move all of his money to another bank. CIBC allowed him to do this, despite warning him beforehand and knowing that he had been targeted by scammers just a few months earlier.

“It is very clear that CIBC did not do everything possible … to ensure that this customer’s financial interests were protected,” said Conacher, the bank accountability advocate.

CIBC did not say why the managers did not contact the bank’s fraud department or Victoria Police with their concerns.

No questions from RBC

But what happened at RBC, Jill says, was incredible.

After Ray transferred all his money to RBC, the bank allowed him to come in every few weeks or so and take out large bank drafts ($50,000 to $395,000) to buy gold. according to the scammer’s latest instructions.

Not a single RBC teller or manager asked questions about the large withdrawals.

“When someone makes unusual and very large withdrawals from their savings accounts, all kinds of alarm bells should go off,” Conacher said.

The scammers then sent a courier to Ray’s apartment to collect the gold.

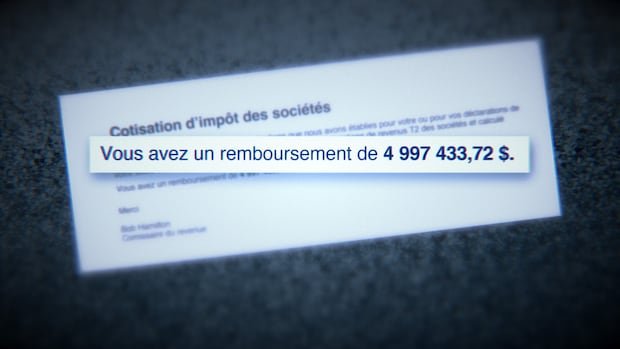

When the old man finally ran out of money, a scammer posed as the chief justice of Canada and told Ray he couldn’t get his savings back until he paid a fictitious tax debt.

Desperate, Ray called his daughter to ask for a loan. When she asked him why he needed the money, he reluctantly told her the details of the months-long ordeal and she realized that her elderly father had been scammed.

The news that it was all an intricate plan was almost too much to bear, Ray said.

“I was devastated,” he said, hanging his head. “I trusted them.”

RBC says the matter is “resolved”

Under Banking Law regulations, banks must have policies and procedures to protect the financial interests of their customers, but Conacher says RBC did not follow them.

“If they had, this wouldn’t have happened.”

Jill sent letters to both banks, detailing how He allowed scammers to victimize his father.

CIBC says it tried to “warn and protect” Ray. The bank shared an email from July 8, 2024 in which a branch manager attempted to set up a meeting with Ray, who declined the invitation.

It took months for RBC to arrange a meeting with Ray and his daughter. The bank later told Go Public that the matter had been “resolved” but did not confirm whether a settlement had been offered. Both Ray and Jill say they cannot comment on those discussions. what it suggests They were asked to sign a confidentiality agreement.

Conacher questions why the scam could unfold for six months, since banks are required to report suspicious transactions and transactions over $10,000 to Canada’s Financial Transactions and Reporting Analysis Center (Fintrac), which monitors the proceeds of crime, money laundering and other criminal conduct.

“Fintrac should have followed up,” Conacher said. “Both the bank and Fintrac should have intervened and prevented this from happening.”

Neither CIBC nor RBC told Go Public whether Ray’s large withdrawals were ever reported to Fintrac..

No commitment

There is no legislation requiring banks to limit liability for customers who have been victims, Conacher says, although there are some protections for credit and debit card transactions.

He notes that countries such as the United Kingdom and Australia have introduced laws that could hold banks liable for failing to prevent fraud. The EU is working to enact similar legislation next year.

“The government should intervene immediately and take swift action… to protect customers,” Conacher said.

The federal governmentld queries orn changes proposed to the Banking Law last year that included considering a “maximum liability threshold” for people who suffer fraud – similar to credit cards, where it is up to the bank to prove gross negligence to hold consumers liable.

The details will be outlined in the next federal budget, but the government revealed some of the changes.last week — and the maximum threshold of liability was not mentioned.

Conacher strongly criticized those new measures as “repeated hot air promises” that are “too little, too late” and largely voluntary.

After Jill contacted Victoria Police, they organized a sting operation and managed to arrest a courier who showed up at Ray’s apartment. The family says they have been told charges will be filed soon.

Jill doubts the police will be able to recover any of the money, but says she’s glad her father is sharing what happened to him because most victims stay silent out of shame.

“I think it’s very brave of you to tell this story,” he said. He also hopes that stricter laws will soon be in place to protect bank customers.

“I can’t even imagine the number of people who are falling victim to scams like this.”

Submit your story ideas

Go Public is an investigative news segment on CBC-TV, radio and the Internet.

We tell their stories, shed light on irregularities and hold public authorities accountable.

If you have a story of public interest, or if you are an expert with information, please contact gopublic@cbc.ca with your name, contact information and a brief summary. All emails are confidential until you choose to make them public.

Read more stories by Make public.

Read about our hosts.