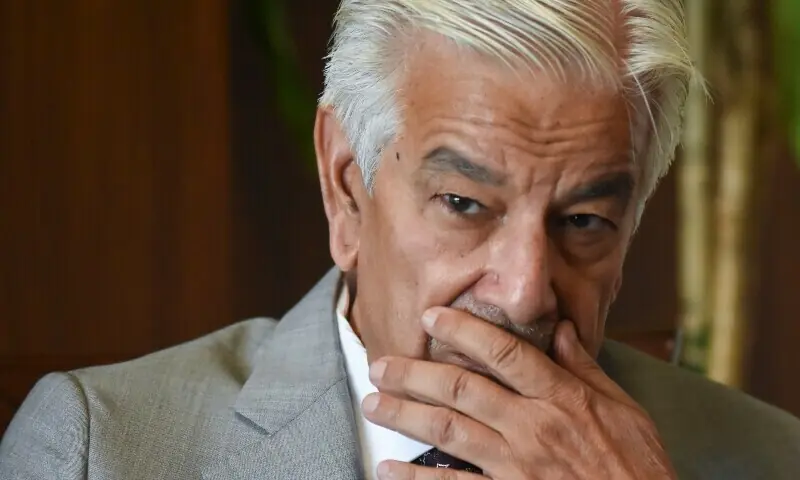

Prime Minister Shehbaz Sharif questioned on Tuesday the contributions made to the National Treasury for the country’s elite class, before presenting the budget for fiscal year 2016.

When heading to a federal cabinet meeting in Islamabad, Prime Minister Shehbaz said: “Today, the federal cabinet will discuss the budget and give its approval. In the previous quarter, the entire nation has faced these challenges. This is not in any way an ordinary achievement.

“The sacrifices made by the common man, the load that the salaried class has taken in the previous budget. They say ‘we are wage earners [class] But it still gave RS400bn to the Treasury […] What have the elite and rich groups contributed compared to us? ” He added.

“This is a question that the elite, including me, has to answer,” said the prime minister.

The Minister of Finance, Muhammad Aurengzeb, will present the annual federal budget today, which is expected to provide some relief to the salaried group, during a session of the National Assembly chaired by President Sardar Ayaz Sadiq.

Aurganzeb, at a press conference yesterday, launched the economic survey of Pakistan 2024-2025, a document prior to the budget that contains details of the main socio-economic achievements during the outgoing fiscal year.

The media reports say that the government is likely to present a budget of RS17.6 billion for the fiscal year that begins on July 1, 6.7 percent less than this fiscal year. He has projected a fiscal deficit of 4.8pc of GDP, against an objective deficit of 5.9pc in 2024-25, according to the reports.

The budget for the fiscal year 26 is expected to prioritize the expansion of the tax base, apply the laws of agricultural income taxes and reduce government subsidies to the industry, to comply with the terms of an IMF rescue of $ 7 billion.

The IMF has urged Pakistan to expand the tax base through reforms, which include taxing agriculture, retail trade and real estate.

The session will open with recitation, followed by the Minister of Finance presented by the Federal Budget, according to a NA notification.

Overangzeb is also expected to present other documents, including the Finance Law 2025, the subsidy demands for next year and the declaration of excessive budget for the two previous fiscal years.

Facing a limited space for new fiscal measures, the Government has resorted to brand change taxes, changing to “expand the tax base” to the search for “equity”, in an effort to justify higher taxes in low -income segments. This change means that lower tax rates will be raised in a wide range of goods and services, a measure that anticipates the Federal Income Board (FBR) will generate maximum income.

The FBR faces significant challenges to meet its tax collection objectives, since doubts persist about their ability to enforce existing tax laws effectively.

Meanwhile, some relief is expected for salaried class in lower tax slabs. Officials indicate that the exemption limit can increase even more, along with a lower tax rate for people who earn around 1100,000 per month.

According to the former Minister of Finance, Asad Umar: “The fundamental question for the Government is at this time: how to increase income and what expenses to reduce.”

“Last year’s budget placed an overwhelming load in the salaried class. This budget must include a reversal of that unfair tax,” he added.

In February of this year, Aurengzeb admitted that there was a massive tax burden in the wage class and indicated that the government can provide them with some relief.