The general secretary of the Organization of Petroleum Exporting Countries says that the world thirst for oil will continue for decades and investment in the sector is necessary to meet those needs.

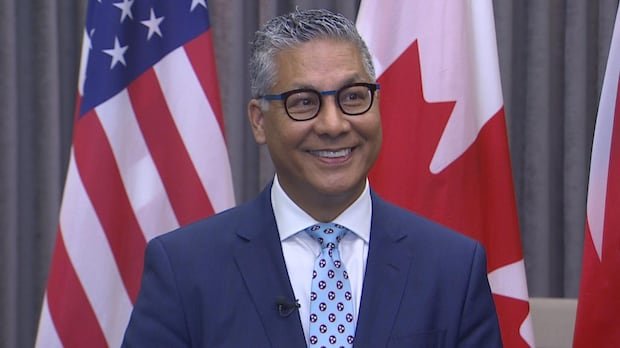

Haitham Al-Ghais made his comments in a speech to Global Energy Show in Calgary on Tuesday, at a time when oil prices fall and experts predict that they could fall later this year.

“In a nutshell, ladies and gentlemen, there is no peak in oil demand on the horizon. The fact that oil demand continues to increase, reaching new records year after year, is a clear example of what I am saying,” he said in his speech.

It is forecast that the demand for primary energy will increase by 24 percent between now and 2050, he said, exceeding 120 million barrels of oil per day. Currently, the oil demand is around 103 million barrels per day.

“Complying with this increasing demand will only be possible with adequate, timely and necessary investments in the oil industry,” he said, pointing out the need for $ 17.4 billion of the United States. In investment in the next 25 years.

Alberta oil and gas praise

The Secretary General used his speech to complement the Alberta oil and gas industry for his ability to increase production over the years, his technological improvements and his role as a leader in the development of carbon capture and storage facilities.

He concluded his speech by stating that OPEC takes climate change “very, very seriously”, and each of its member countries has signed the Paris Climate Agreement.

Even so, he criticized the net-zero objectives of companies and countries as “unrealistic”, “set in the deadlines” and “separated from reality.”

Instead, he said that the world should focus on reducing emissions and using all forms of energy to meet the needs of the growing world population.

In 2024, the emissions of the energy sector grew by 0.8 percent compared to 2023, according to the International Energy Agency, while the global economy expanded by more than three percent.

In Canada, the Federal Government is already on its way to losing its 2030 goal to reduce carbon emissions by at least 40 percent below 2005 levels by 2030.

Challenging times

The speech comes at a time when oil faces the weak prices of basic products and many companies are withdrawing the investment.

OPEC countries are producing more this year, along with more production in Canada, the United States and Guyana. Last month, the Vienna headquarters agreed to increase production by 411,000 barrels per day in June, accelerating the gradual yield of 2.2 million barrels per day.

For the context, Canada produces around five million barrels per day in total.

At the same time, global oil consumption is not increasing as expected initially due to the deceleration of global trade.

“The demand is not falling, but we are in a period in which the growth of demand is weak. In fact, if Covid year of 2020 takes out the world financial crisis of ’08 -’09, it seems that it could be the weakest year of growth since 2001,” said Jim Burkhard, global chief of crude oil investigations with research of basic products of Global S&P, in an interview with CBC news.

Great predicted fall

North America oil prices average around $ 65 from the USA per barrel in recent days, but the last S&P oil prognosis published this week anticipates that prices could fall into the high $ 40 per barrel at the end of this year.

“We could see a significant difference in the price for the end of the year compared to the place where we are at this time. Much depends on the economy, of course, and the concern for rates and OPEC+ can alter its decisions at any time. But at this time, on current trends, it seems that there will be much more supply related to demand at the end of this year,” he said.

More than 30,000 people from 100 countries are expected to attend the Global Energy Show in Calgary this week.