Mumbai: The Mumbai Income Tax Court of Appeal (ITAT) has ruled in favor of an individual who said that his fiscal residential state is the one of A ‘non-resident‘As had spent 210 days at work abroad, reports Lubna Klle.

As India do not tax income abroad In the hands of a non-resident, M Gulati did not reveal his income abroad at RS 1.2 million rupees for the 2015-16 financial year. He argued that he had spent less than 182 days in the country and was not a resident. But he said that of the 210 days, it had spent 28 days looking for work and, therefore, a fiscal resident of India. Itat made it clear that the fiscal residential state of an individual must be determined only by the number of days spent in India.

The ITAT rejected the affirmation of the Income Tax Department (TI), which had recomputed Gulati’s stay outside India, since partly composed of days in the job search. The ITAT order provides clarity about the fiscal treatment of people who divide their time between employment and job search abroad. It reinforces that any period spent outside India for employment or in search of employment must count for the determination of the non -resident state.

The decision will benefit the expatriates who go abroad in search of a job and obtain employment.

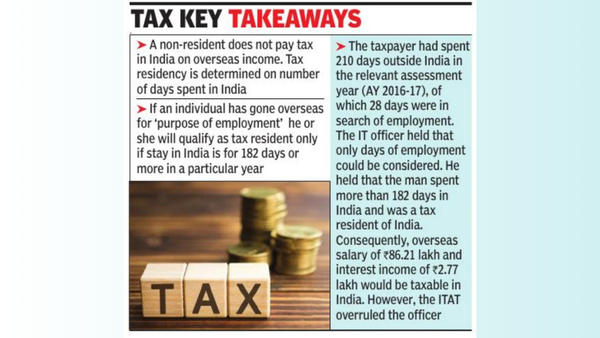

A person who is a fiscal resident of India has to pay taxes on their global income. A non -resident does not pay taxes in India on their income abroad, but only in income that accumulate or arise in India (example: rental of properties in India, bank interests, etc.).

The number of days that remained in India determines the Fiscal residence state.

According to the provisions of the Law of IT, namely: Explanation 1 to Section 6 (1), if an individual leaves India with the “employment purpose” abroad, will qualify as a fiscal resident only if the stay in India is for 182 days or more in a particular year.

Since the 2020-21 financial year, the period was reduced to 120 days or more, for those people whose total income (which are not foreign sources) exceed the 15 LAKH of RS.

The IT officer said Gulati had spent 210 days outside India in the year of relevant evaluation (AY 2016-17), of which 28 days were looking for employment.

He argued that they could only consider real employment days. Therefore, according to a revised calculation, he said that Gulati had spent more than 182 days in India and, therefore, was a fiscal resident. Consequently, the salary abroad of RS 86.2 Lakh and the interest income of RS 2.8 Lakh would be subject to taxes in India. The Commissioner of Appeals confirmed the position of the IT officer by maintaining that during the 28 -day period, the taxpayer had not received any salary and the adjustment in days was carried out correctly.

However, the ITAT that depends on the judicial precedents did not agree and annulled the stand of the IT department. The Fiscal Court said that seeking employment abroad also qualifies as a legitimate purpose under explanation 1 to section 6 (1). The fiscal residential state of an individual must be determined only depending on the number of days spent in India.