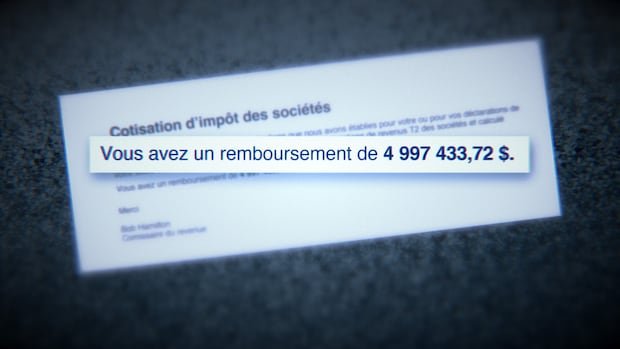

More than two years after paying $4.99 million in an allegedly fake refund, the Canada Revenue Agency is stuck in Federal Court trying to figure out where the money went and how to get it back.

The seven-figure refund was issued through the CRA’s automated processes in spring 2023 to Distribution Carflex Inc., a cash-strapped auto body shop in Quebec’s Laurentians region.

According to internal records obtained by the CBC the fifth power and Radio-Canada, the $4.99 million transaction was made automatically as it did not meet the $5 million threshold for manual review on this type of tax refund.

A source with inside knowledge of the CRA’s workings said returns are routinely processed electronically without human oversight, even in cases where millions are paid that would later raise red flags.

“There should be eyes on that transaction, but there aren’t, and that’s the problem,” the source said.

CBC is not revealing the identity of the source, who is not authorized to discuss the internal workings of the CRA or specific tax files.

If the $5 million threshold had been met, CRA auditors would have He performed a manual review of the tax return and may have noticed possible irregularities, the source said.

The $4.99 million refund was issued on the premise that Carflex had paid taxes on a large capital gain.but auditors later found no record of such payment.

The payment first attracted the attention of TD Bank, the institution where the money was deposited, and not the CRA, according to leaked records.

The leaked Carflex documents are the most recent example of numerous instances discovered by the fifth power and Radio-Canada, which show that the CRA has allegedly been cheated to pay large refunds without performing basic checks, affecting tens of thousands of taxpayers and raising questions about the credibility of the agency with the public.

Carflex owner Yvan Drapeau and his lawyer could not be reached for comment by email or phone.

According to documents filed in court, they defended the transactions as valid and fought the CRA’s attempts to freeze their account.

(Sébastien Labelle/Radio-Canada)

In Federal Court, the CRA is trying to recover the money, claiming the company “was not entitled to this refund.”

“Carflex is the one that caused the CRA to overpay through transactions that were questionable and potentially fraudulent,” agency officials said in court.

Call for external investigation

At issue is the CRA’s use of thresholds that determine when a manual review is required before refunds are paid.

The CRA uses such thresholds internally and does not make them public, but some scammers try to game the system by filing false returns that fall just below these limits, according to the source.

“For an automated process to allow a payment, there has to be a threshold in place,” the source said. “No one is really looking at the vulnerabilities of these automated processes.”

The leaked records indicate that Agency officials realized that “no mitigation measures existed to prevent” the allegedly suspicious plan.

Sources linked to the CRA told Radio-Canada/the fifth power that the government needs to hire outside experts to examine the Agency’s security measures. The agency is the responsibility of the Minister of Finance, François-Philippe Champagne.

“The agency can’t police itself. It just can’t, because it will just make things look better than they are so it can control them.” [avoid] scrutiny,” said one source. “It doesn’t matter who the minister is. “This is ingrained administrative behavior.”

The CRA “needs to be externally investigated from the ground up,” another source said.

A tangled web

The Federal Court is unraveling the complex transactions that led to the legal showdown between the CRA and Distribution Carflex Inc.

In a June decision, Federal Court Judge Yvan Roy said the CRA’s $4.99 million refund to compensationanyone seemed to have been “artificially generated.”

After reviewing court records, two tax experts from McGill University in Montreal said the CRA’s automated fuOperations apparently missed the fact that Carflex was claiming a refund for a 2021 tax bill that would not have been paid.

“There wasn’t a single real person from the CRA looking at the case. This was all done using computers,” said Raphaël Clément, a tax lawyer and PhD candidate who reviewed publicly available documents with McGill law professor Allison Christians.

“To get a refund, you must pay [taxes] first,” he said.

Carflex was a relatively small company, having claimed expenses of $380,000 in 2020-21, with just $242,000 in revenue, according to court records.

Leaked records show that alarm bells first sounded at TD Bank in April 2023, when officials noticed that the $4.99 million check issued to Distribution Carflex Inc. had been deposited into an account recently opened by a numbered company.

Records show Carflex owner Yvan Drapeau had already withdrawn $1.5 million toward the purchase of a $2 million condo in Montreal.

After TD Bank alerted the CRA, the remaining funds were frozen.

Drapeau immediately objected, stating in an email to TD that “the bank should not be able to seize my assets without notice and put me in a precarious situation.”

The CRA intends to interview Drapeau’s business partner in the real estate transaction, Jean-François Malo. A few days after Drapeau purchased the condo, ownership was transferred to a trust called Fiducie Annie, which court records show is under Malo’s control.

Malo has been invoking attorney-client privilege to avoid answering the CRA’s question, arguing that funds related to the transaction were transmitted through a notary.

Judge Roy rejected this reasoning in a June decision, stating that “in no way has the existence of an attorney-client relationship been established.”

As a result, the judge asked Malo to answer the CRA’s question on the matter.

In response to questions from CBC and Radio-Canada, the agency declined to comment specifically on the Carflex case, but said it is willing to use “all available measures to ensure compliance.”

The alleged scheme began when the company reported a capital gain of $32.9 million on its 2021 tax return, without providing any supporting documentation, according to information filed in court by the CRA.

That capital gain triggered a $7 million tax charge. However, Carflex never paid that amount, according to the CRA.

The company then filed a tax return for fiscal 2022, which indicated that Carflex had paid $13 million in dividends to shareholders. That allowed the company to get a partial refund of $4.99 million on its 2021 tax bill, according to information filed in court.

Clément said that, in his opinion, “if a human had looked at the file, they would have quickly realized that there was a problem.”