The companies on both sides of the border with Canada-United States are fighting. And they are not just tariffs. They are the vast new compliance requirements that have to meet and the bureaucracy that is as confused as companies. That is to cost time and money when companies cannot afford to lose.

The central table of the federal government position is that Canada has ensured radical exemptions to US tariffs for the vast majority of products.

“Canada currently has the best treatment of any of the United States’s commercial partners in the world: 85 percent of our trade with the United States has no tariffs,” said Prime Minister Mark Carney this week, and added that Canada has the lowest rate rate in any country in the world.

Don’t tell Patrick Fulop. It went through the process of complying with the Canadá-Mexico-Mexico (Cusma) agreement, the commercial agreement that replaced NAFTA in 2020.

The Fulop company, Grappling Smarty, based in Quebec, sells what he calls a fictional grip. It is like a human boxing sack, but specifically built so that MMA’s fighters can practice fighting and wrestling movements. The seventy -five percent of their sales go to American customers.

Tariff shock was quite bad. To worsen things, how they have been applied has been very arbitrary.

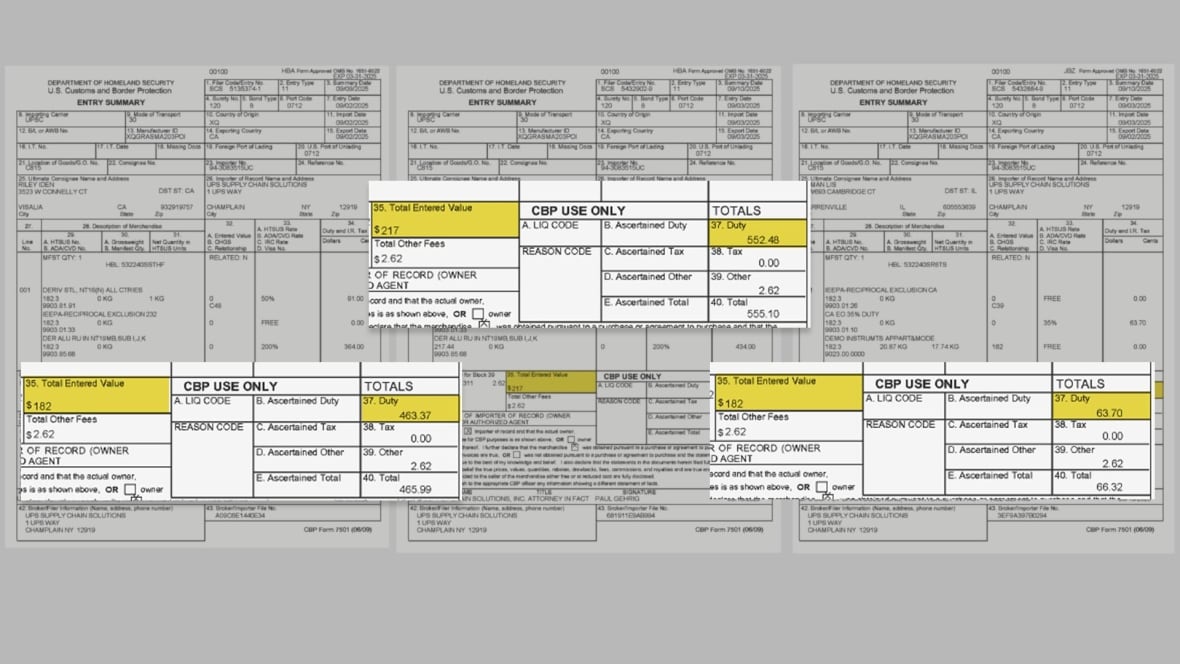

Fulop shared dozens of invoices with the CBC news that show how much customs and border protection of the United States were claiming. Page after page showed different calculations using different tariff codes. An invoice charged $ 66 citing a set of rates. Another charged $ 555 using a different set of rates. Both were for the same product of $ 250.

“We are talking about 100 to 200 percent. I think, on average, it is 150 percent that we have been paying in those orders. It makes absolutely no sense. There is no way that Canadian companies can continue to serve the US client in this environment,” he said.

Fulop sends its products through UPS that also acts as a runner and charges import tariffs. UPS said in an email that he was “actively working” to solve his concerns.

But on its website, UPS says that duties will be evaluated based on effective rates or specific tasks according to the country of origin.

That has left a lot of space for interpretation and confusion about which rate should be applied to which products. And it is precisely the type of things that trade experts have been to notice.

‘Layer on bureaucracy layer

Scott Lincicome, vice president of the Cato Institute in Washington, says that companies, runners and loaders have no idea how to process the appropriate rates.

“You have really spent almost the night, a fairly simple system to one that has a layer on a layer on bureaucracy layer, and is very complicated and is constantly changing,” he said.

Lincicome says it used to be quite clear which tariffs were applied in specific cases. There were judicial cases and volumes of commercial documents that were established in thorough clarity how the system worked. Since the president of the United States, Donald Trump, began to impose tariffs last winter, says that companies have had to examine various types of rates imposed at different rates for different countries and different products.

“Now, it is much more complicated because the product may not have only a reciprocal rate, but a rate of section 232. There is a country rate, I mean, now there are 100 rates of different countries,” he said.

And in some cases, these rates are intended to be stacked, that is, one is added above the other.

The shipping companies that accept the product in the US. They are responsible for ensuring that the appropriate rate is paid. So, some experts say that these companies are simply charging the maximum rate and allowing the exporter to solve if they should obtain a refund.

Commerce lawyer Mark Warner has warned about that. He has also questioned whether all the companies that claim that it has been certified in Cusma really meets the criteria. Warner says that there are strong sanctions for all involved in the shipping products that do not actually comply.

“With the criminal sanctions for fraudulent compliance, I do not believe that logistics companies want to assume any risk,” said Warner, director of the Toronto Maaw Law firm.

Whatever reason, the result is even more uncertainty. And that is just another barrier to trade.

Back on Smarty Grappling, Fulop is struggling to find a solution. It is covering the costs of rate for existing orders, but doubled its price to cover future orders. Meanwhile, it is reinforcing its national marketing and tries to find new customers in other markets.

But it is mostly frustrated because Cusma’s fulfillment that worked so hard to ensure does not seem to be worth a lot at this time.

“We thought we were getting a good treatment because Cusma was supposed to be respected, and that is not the case,” he said.