In his efforts to sell his fight for the flag, Pakistan International Airlines (PIA), the Government has received expressions of interest from five parts, including business groups and a military property company, the Ministry of Privatization said Thursday.

The offers were presented before a June 19 deadline to acquire up to 100 percent of PIA, which has accumulated more than $ 2.5 billion in losses in approximately a decade. Even so, after greater restructuring, he registered his first operational gain in 21 years in fiscal year 2024-25.

The sale is seen as a proof of Pakistan’s capacity to throw state companies that make losses and meet the conditions of a rescue of international monetary funds of $ 7 billion. It would be the first important privatization in almost two decades.

Eight parts presented their expression of interest, but only five of them provided qualification documents, the ministry said in a statement.

Among the five groups is a consortium of main industrial companies: Lucky Cement Ltd, Hub Power Holdings Ltd, Kohat Cement Co Ltd and Metro Ventures.

Another is directed by the investment firm Arifib Corp LTD and includes the fertilizer producer Fatima Firtilizer CO LTD, to the private education operator the city school and the real estate firm Lake City Holdings.

Fauji Fertilizer Company LTD, a military property conglomerate, the Pakistani Air Blue Ltd airline and a consortium that includes the Bahria Foundation, the domestic carrier Serene Air and Equitas Capital LLC, based in the United States, also presented documents.

“The Government will review the documents and give the qualified parties access to data for due diligence,” said the statement.

Complete disinvestment

Once a leading global airline, PIA resumed European flights in January after a four -year EU prohibition linked to security concerns, and is looking for authorizations from the United Kingdom, seen as a key to their change. Industry experts say that the winning bidder is expected to be associated with a foreign airline to execute operations.

An earlier attempt to sell the airline failed as an offer of $ 36 million of the real estate firm Blue World City did not reach the floor price of $ 305 million, with concerns about debt, staff and limited control.

This time, the Government offers a complete divestment, has ruled out the sales tax of leased aircraft and is providing limited protection of legal and fiscal claims. About 80 percent of the airline’s debt have been transferred to the State.

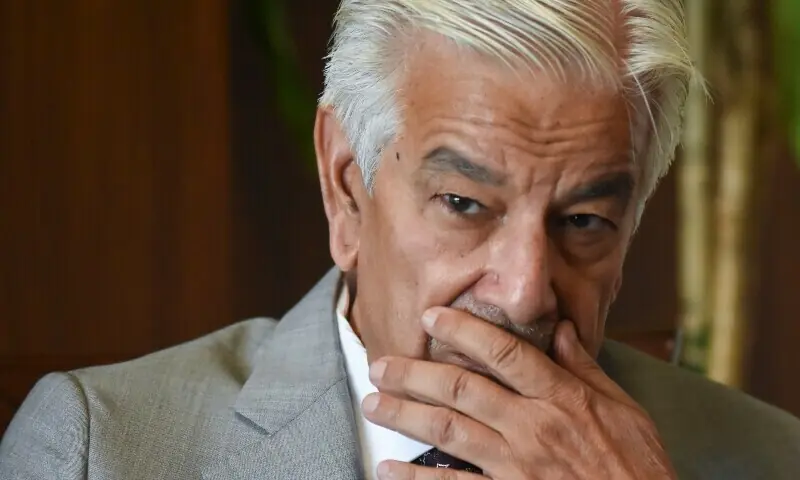

“We are pointing to RS86bn in the income of privatization this year,” said Privatization Minister Muhammad Ali Reuters. “For PIA, in the last bidding round, 15 percent of the income went to the government, and the rest remained within the company.”

He said that bidders would be prequalified in early July, and due diligence lasted two or two and a half months, with the final offers and the expected negotiations in the fourth quarter of 2025.

Officials expect the sale to revive the stagnant impulse of privatization. Other planned agreements include the Roosevelt hotel and several electrical firms in mid -2026.

“From the Roosevelt hotel, we expect more than $ 100 million as [the] First payment during this year, ”said Ali.