Islamabad: The Government on Wednesday reported a parliamentary panel that around RS3.5 billion in savings had been secured through reviews to obtain energy purchase agreements with 29 private electrical and state -owned power plants, which cover its terms of three to 20 years.

In addition, the circular debt is expected to decrease to RS400-450 billion by the end of the year, below around RS2.4TR currently.

At a meeting of the Senate Permanent Power Committee, chaired by Senator Mohsin Aziz, the power division also confirmed that the federal cabinet had returned the review in the solar network measurement policy authorized by its Economic Coordination Committee (ECC) for more deliberations and revisions.

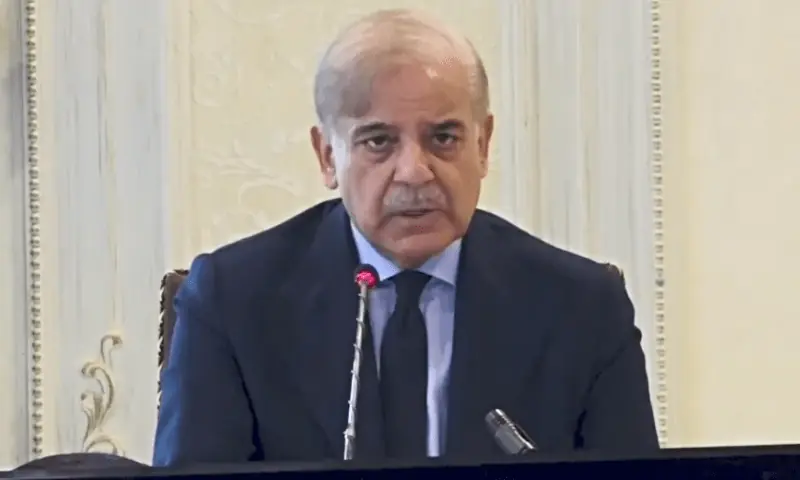

The Government will not have to pay around RS3.498R to these 29 independent energy producers (IPP) and government power plants (GPP) after these reviews that were otherwise due to their lives in the sections between three and 20 years, depending on their real date of commercial operations, the Minister of Energy, Awais Leghari, said the meeting.

These included the termination of contracts with six IPP and reviews with another 14 under energy policies of 1994 and 2002 and nine plants based on Bagebas.

The cabinet returns the solar network measurement policy for review, said the body of the Senate

The meeting was informed that agreements with IPP capacity of 12,000 MW had signed a total of 38,000MW. The six 3,200MW capacity government plants have also been reviewed, while another 15,615MW in the public sector have not yet completed. The power minister said that the PPA review process will be completed at the end of April or mid -May of this year.

The terminations of six IPP contracts involved RS411bn in savings, eight Bagebas -based projects involved RS238Bn and another 14 IPP under the 2002 and 1994 policies provided RS9222b in savings, an official told the meeting.

Contracts in public sector generation companies have also been reviewed and approved by the cabinet, the meeting was told. Total savings in capacity payments and other obligations for two plants in Guddu and Nandipur amounted to RS355B and RS2.2tr of four floors based on LNG in Punjab.

The impact of these savings would be transmitted to consumers once the tariff reviews go through the current regulatory process, after which the prime minister will make a formal announcement, the meeting was told.

Senator Shibli Faraz criticized the Government for premature discussions about an alleged tariff reduction of RS8 per unit. However, the Minister of Power defended the measure, stating that the IMF announcement of the agreement at the personnel was proof that government policies were directed in the right direction.

He said that the reviewed contracts are currently in regulatory processing, and savings will be included in the quarterly rate (QTA) adjustment before a formal ad.

Senator Mohsin observed that the 40 % industry had already been closed due to high energy prices and the Federal Income Board (FBR), with another 20 percent were on the edge of the closure, leaving only 40 % of the industry to survive.

Discussing the net solar measurement, Shibli Faraz expressed concern that investors distrust changes in the policies in halfway, which could deter new investments.

Answering a question about RS1.2TR loans for circular debt, the Minister of Energy said the amount would be to finance through the existing debt service surcharge. I expected the process to be completed next month and expected that, together with other internal adjustments, this would reduce the circular debt of the electricity sector to approximately RS400-450 billion RS2.4TR today.

The Committee sought detailed information, noting that the authorities have not yet provided the start date of these projects, the final price and the local manufacturing cost of the plants.

Posted in Dawn, March 27, 2025