Pakistan is set to sign a staff level agreement (SLA) on a review of its lending program with the International Monetary Fund (IMF) this week, Finance Minister Muhammad Aurangzeb said.

Last week, an IMF mission led by Iva Petrova concluded talks with Pakistani authorities on reviews of the implementation of the $7 billion Expanded Facility (ESF) and the $1.1 billion Resilience and Sustainability Fund (RSF). The program’s performance as of the end of June this year (the period under review) has been mixed.

The mission left Pakistan without signing an SLA on the second review of the SAF (agreed in 2024 to shore up the economy after a severe financial crisis) and the first of the RSF climate loan. However, the Fund said “significant progress” had been made in reaching the staff agreement.

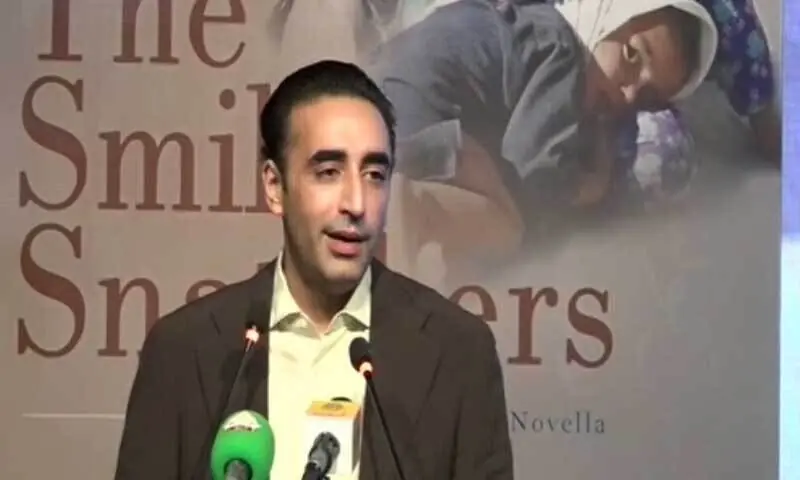

“Over the course of this week, we hope to be able to complete the SLA,” Aurangzeb said. Reuters during an interview on the sidelines of the IMF’s World Bank annual meeting in Washington.

“The mission was on the ground for a couple of weeks, we had a very constructive dialogue with them on the quantitative benchmarks, the structural benchmarks, and we have been having some follow-up discussions,” the finance minister said.

Earlier today, Aurangzeb met IMF Middle East and Central Asia Department Director Jihad Azour and discussed Pakistan’s reform agenda. Before leaving for the United States, the Finance Minister had expressed optimism that the SLA would be finalized during his visit to Washington.

The SLA is a key step needed to pave the way for another $1.24 billion payment from the lender. Countries under IMF lending programs must undergo periodic reviews that, once approved by the Fund’s executive board, trigger payment of the next tranche of IMF financing.

Official sources said there was no immediate need for additional fiscal measures to cover shortfalls, although the fiscal target may have to be revised depending on first-quarter GDP data, which will be released in the last week of December.

At that time, the question of new measures or changes in rates would come from January 1, 2026, to cover the gaps in the first half of the fiscal year, in view of the biannual nature of the review.

Last month, Prime Minister Shehbaz Sharif had urged the lender to take into account damage from recent floods in its review of the country.

Pakistan and the IMF reached a three-year aid package worth $7 billion in July last year, giving the nation a much-needed respite. The program aimed to enable Pakistan to “consolidate macroeconomic stability and create conditions for stronger, more inclusive and resilient growth.”

In May this year, the IMF board approved a new $1 billion loan to help Pakistan strengthen its economic resilience to climate vulnerabilities and natural disasters. However, the disbursement of funds is dependent on the successful completion of reviews under the SAF.

“High hopes” about the privatization of PIA

The privatization initiative, part of a long-delayed sale of state assets under an economic reform and fiscal stabilization agenda, was expected to gain traction in the fiscal year ending in June after disappointing results last year.

“This is something very important as part of our economic roadmap,” Aurangzeb said.

Pakistan was also moving forward with the sale of three power distribution companies and national airline Pakistan International Airlines (PIA).

“We are very hopeful,” Aurangzeb said, citing the prospects of qualified bidders for PIA after lucrative routes to Europe and Britain were opened, making it “a very good proposition for investors.”

The transaction would mark the country’s first major privatization in about two decades.

A previous attempt failed last year after a single low bid was received, but the government has since attracted interest from five domestic business groups including Airblue, Lucky Cement, investment firm Arif Habib and Fauji Fertiliser. Final offers are expected later this year.

Meanwhile, Aurangzeb expected the government to launch a Green Panda bond – the first denominated in Chinese yuan for Pakistan – before the end of the year and return to international markets next year with a bond sale of at least $1 billion, although details were still to be decided.

“Euro, dollar, Sukuk, Islam Sukuk… we keep our options open,” he said.

Aurangzeb meets with IMF and World Bank delegations

Aurangzeb and Azour of the IMF held delegation-level talks in Washington, where they exchanged views on Pakistan’s reform agenda, according to a press release from the Ministry of Finance.

The ministry said Aurangzeb had a “busy first day” of his official visit to the United States, attending high-level meetings on the sidelines of the IMF and World Bank (WB) annual meetings.

“The Finance Minister and his delegation had a key meeting with Azour. Both sides exchanged views on Pakistan’s reform agenda and reaffirmed their shared commitment to maintaining the current reform momentum,” the press release said.

He added that the meeting also reviewed progress on the second review of the EFF and recognized the “importance of maintaining macroeconomic discipline.”

In a separate meeting, Aurangzeb had a “broad engagement” with WB Senior Managing Director Axel van Trotsenburg where he appreciated the Bank’s continued commitment to Pakistan’s national development agenda.

“The minister reiterated that the climate crisis remains an existential challenge for Pakistan, referring to the devastation caused by the recent floods and its serious impact on the agricultural sector and GDP growth,” the statement said.

“He emphasized the need for greater investment in climate adaptation and mitigation measures and agreed on the importance of mobilizing additional resources to manage future natural calamities,” he said.

The minister will visit the capital of the United States for the plenary meetings of the IMF and the WB from October 13 to 18. The meetings bring together finance ministers, central bankers and global development leaders, offering Pakistan a crucial platform to secure the next tranche of the IMF, drive economic reforms and engage international partners on growth, investment and resilience.

Rush of meetings to strengthen partnerships with global financial institutions

Following meetings by Aurangzeb and his team with officials from various stakeholders in the international business sector, the Finance Ministry said the engagements in Washington reflected the government’s “determination to deepen economic cooperation, strengthen partnerships with international financial institutions and accelerate Pakistan’s transition from stabilization to sustainable and inclusive growth.”

“The visit aims to further strengthen Pakistan’s engagement with key international financial institutions, development partners and private sector stakeholders,” the statement added.

According to the press release, Aurangzeb attended the Commonwealth Finance Ministers’ Meeting, where he stressed the importance of “prioritizing concrete actions to promote a prosperous and resilient Commonwealth.”

He expressed support for the operationalization of the Commonwealth Infrastructure and Financial Resilience Centre, as well as the Technical Assistance Fund for peer review and capacity development.

He reiterated the central importance of climate finance for developing countries like Pakistan and emphasized the urgent need to operationalize mechanisms such as the Loss and Damage Fund, the statement said.

Aurangzeb was also received by the leadership and members of the United States-Pakistan Business Council (USPBC). He briefed the participants about the positive trajectory of Pakistan’s macroeconomic indicators and termed private sector growth as “vital to sustain economic momentum.”

According to the press release, he reaffirmed the government’s commitment to addressing business challenges and providing maximum relief, highlighting the recent trade agreement with US authorities and “expressing optimism for better government-to-government and business-to-business engagements in key sectors, including mining, agriculture, information technology and pharmaceuticals.”

Aurangzeb also met with Robert Kaproth, US Treasury undersecretary for international finance, and adviser Jonathan Greenstein. During the debate, he highlighted Pakistan’s “strong economic fundamentals”, supported by the ongoing IMF programme.

He welcomed the successful conclusion of negotiations with the US administration that led to a tariff agreement and briefed officials on Pakistan’s recent legislation to regulate virtual assets. Additionally, he invited American companies to explore investment opportunities in Pakistan’s oil and gas, minerals, agriculture and information technology sectors, the statement said.

Aurangzeb also met with representatives of Citi Bank, where he “recognised Citi’s long-standing partnership with Pakistan and appreciated their continued commitment.”

“The minister shared an overview of Pakistan’s stabilizing macroeconomic outlook, driven by ongoing structural reforms and validated by international credit rating agencies. He also highlighted Pakistan’s growing role as a regional hub for digital innovation and financial services, assuring that the government would give due consideration to Citi’s proposals,” the statement said.

The statement added that the minister also interacted with American and international media, including interviews with the Associated Press and Reutersand attended a dinner in honor of the Pakistani delegation hosted by Pakistani Ambassador to the United States, Rizwan Saeed Sheikh.