Companies that paid the Digital Services Tax now missing will have to wait for Ottawa to approve a new legislation before they can obtain their reimbursement, the Canada Revenue Agency confirmed.

Prime Minister Mark Carney announced Sunday night that Canada was abandoning the tax on world technological giants in an attempt to restart commercial negotiations with the United States.

The first payment was due on Monday and would have cost collectively to US companies such as Amazon, Google, Airbnb, Meta and Uber around $ 2 billion of the US. The tax was a three percent tax on the income collected by the largest digital companies of its Canadian users.

The first payment was retroactive at 2022.

A CRA spokesman said the agency raised some income from the Digital Services Tax (DST) before Ottawa reversal, but did not quote an amount.

The spokesman said that the Parliament must approve the legislation that formally revokes the tax so that taxpayers recover their money. Parliament members are currently at rest and are scheduled to return on September 15.

The CRA renounced the requirement for taxpayers to submit a DST statement before the deadline of June 30 and will not request any related payment in the meantime.

Carney said that Canada and the United States resumed commercial conversations on Monday morning and are still pointing to an agreement for the July 21 deadline that he established with the president of the United States, Donald Trump, at the G7 summit in Alberta last month.

After Carney announced the end of the DST, the White House said Canada had “ceded” under Trump’s pressure.

The prime minister said Monday that the measure was “part of a larger negotiation” and “something we expected, in the broadest sense, that it would be part of a final agreement.”

Prime Minister Mark Carney said Monday that eliminating the digital services tax was a part of the largest commercial negotiation with the United States, although the White House said Carney “gave up” when commercial conversations were canceled. Since then the conversations have been resumed.

Carney said the decision would provide companies with certain certainty.

“It makes no sense to raise taxes of people and then send them,” he said Monday.

Some companies reported that last minute change caused confusion among companies that were in the process of paying the tax.

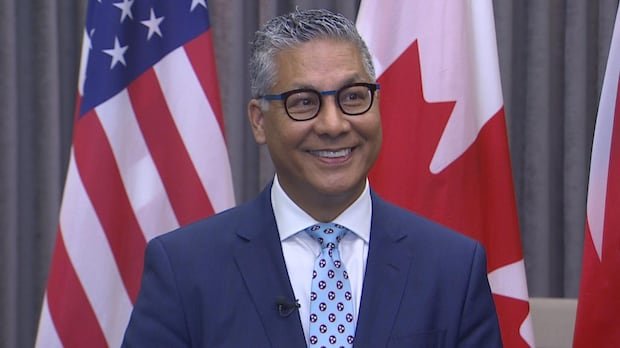

Tariq Nasir, partner of the indirect fiscal practice of Ey Canada, said on Monday that some companies have been instructed to pay the tax, but the payments were not happening in the CRA.

He said that the companies that have made payments wondered how to realize in their quarterly statements, which were presented in next month.