Los Angeles-Allas the mornings for 47 years, the mother happily from Cowart woke up in her room full of sun with view of an exuberant garden and the mountains of San Gabriel beyond.

That garden and much of his mother’s house are now covered with ashes and soot after the Eaton fire crossed Altadena on January 7, destroying more than 9,000 residences in the community of foothills north of the center of Los Angeles. At least 17 people died and thousands were displaced.

Cowart’s childhood house survived the flames, but is surrounded by carbonized houses and sweeping businesses near what used to be the bustling commercial corridor of Altadena. The neighborhood in front of Lake Avenue suffered some of the worst damage in one of the two main fires that extended by Los Angeles County in January.

The fires of Eaton and Palisades moved about 150,000 residents, and many remain in rental and hotel rooms almost two months later. The survivors whose houses are standing in the face of smoke remediation and restoration costs, as well as insurance companies that are low -death payments even though some offer smoke damage coverage.

NBC News spoke with seven owners whose houses survived the fires. Six of them paid the coverage of smoke damage through insurance, and one did not have the option through the insurer of the last state resort.

They still recover from destruction, now face tens of thousands of dollars in costs or more to clean deeply and remedy the remaining toxins within their homes. They anticipate being displaced for months as they begin to rebuild.

“It’s really complicated to be in a house that didn’t catch fire,” Cowart said. “There is such a gray area with insurance thinking:” I just erase everything and it will come back as it used to be. “But it’s like, ‘no, I have soot and ashes that I can see with my eyes.'”

The insurance industry has been tense in California, where forest fires are becoming larger and more mortal every year. The main insurance companies have stopped writing new policies or are refusing to renew existing ones to compensate for shooting costs in much of the State.

The residents were blinded last year when State Farm, the largest insurer in California, announced that it would eliminate the coverage of 72,000 houses and apartments. He blamed the costs associated with inflation, exposure to catastrophe, reinsurance and regulations for his need to protect his results.

On Friday afternoon, Andrea-Marie Stark, a resident of Altadena, emerged from a state-owned tent of the farm frustrated by the lack of progress to obtain her approved remediation estimate. The service was scheduled to start on Monday at his three bedroom house and two ranch -style bathrooms in front of Eaton Canyon, where the fire was first reported.

But State Farm had not yet approved the estimate, which varied from $ 80,000 to $ 100,000 of wall isolation, eliminates harmful particles from all surfaces and replaces furniture, clothing and appliances exposed to excessive smoke and ashes.

“I worry that I will lose my place in line,” Stark said about the approval delay. “And then I could lose a place to live.”

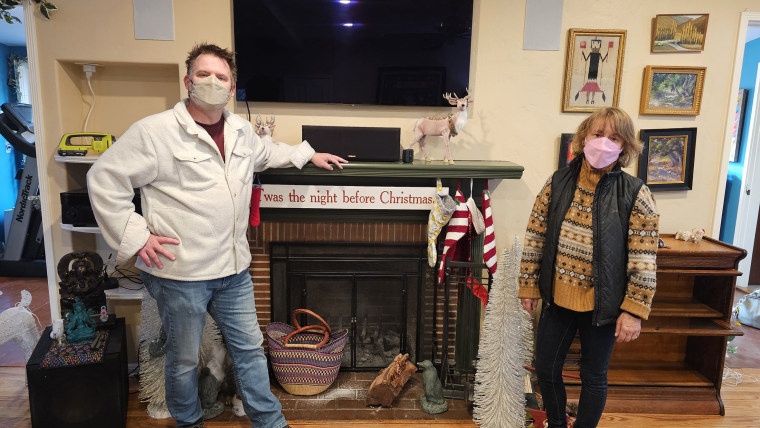

Stark’s house is one of several that survived hell in his block, but his proximity to the flames meant that everything inside was covered with a thick hollin layer. The Christmas decorations were gray in the ash, and their clothes have the strong smell of smoke.

A carbonized smoked smell remains on Stark Street. A neighboring house has been razed to its base, with only the chimney that is standing. In the distance, the green moss and the leaves sprout in the middle of the burned branches and the fallen limbs of Eaton Canyon.

Stark and her husband evacuated the house of a friend the night of fire after securing her four rabbits, five chickens, three cats, a dog and a horse in her boxes. They have been jumping from a friend’s house to the house of friends since then. They hoped to return to Altadena in mid -March after having reserved a smoke remediation company that said it could complete the work quickly.

But State Farm had not responded to his claim for two weeks, and worried that he had to pay for the remediation herself, plus the rent if her appointment had to be reprogrammed.

In a statement sent by email, State Farm said that it is “committed to paying what we owe, of promptness, molks and efficient.” Until February 26, it has received more than 11,750 fire and fire -related cars claims and has paid almost $ 2.2 billion to customers, he said.

To deal with anxiety associated with surviving a catastrophic event, Stark and her husband began a support group on Monday night for residents whose houses are still standing. It is a way for people to talk openly about what few others can understand.

“Security is an internal feeling. Security is external, and both break at this time, ”said Stark, a trauma -trained counselor. “I don’t want to express this to someone without a home, you know, because I don’t want to miss their experience and make them think that I am not grateful. That is called Survivor’s fault. “

The smell in Marcie Habell’s house, Altadena, the nausea. A remediation company recommended taking it to asparagus to restore it completely. You cannot imagine to return to that at this time, much less sit on your fabric sofa or wear any of your towels or bedding.

“I can be in my house for less than five minutes,” said Hayell, whose house is one of the two stops in his block. “It is crazy that has happened, and then, in addition, the way in which insurance behaves only aggravates tragedy.”

She has been summoned by more than $ 22,000 for toxicity tests, and hopes that the rent can cost between $ 4,000 and $ 4,500 per month. That is also paying your mortgage if your insurance company does not accept to cover the total cost, he said.

“We are receiving zero orientation from anyone for those of us who have a home and we are surrounded by the Apocalypse,” he said.

Michael Sollner, an attached commissioner of California insurance, said in a statement that “smoke damage is real and that insurance companies must investigate claims properly, not directly deny them or press the owners to accept less than they are owed.”

More than 33,710 insurance claims related to the fires of the Los Angeles area have been presented, and almost $ 7 billion have been paid in claims, according to the State Department of Insurance.

Cowart is handling the smoke damage of his mother of Dallas, where he has been living for more than a decade. He flew to Los Angeles on January 8 to pick up his mother from a friend’s house and took her back to Texas. Cowart’s mother, Faye Howard, has early starting Alzheimer’s and fights to be in a new place. But Cowart fears that its old neighborhood will be too toxic to return.

Initial estimates to remedy the two bedroom house and two Spanish -style bedrooms began at $ 55,000. A landscaper offered $ 3,000 to restore the garden and eliminate potentially toxic soil. Including the elimination of furniture and the purchase of new clothes, Cowart Fears, the cost to completely restore his mother’s house and everything in it could quickly exceed $ 100,000. Howard’s adjuster has not finished his payment or agreed to pay the long -term rent, while Howard remains displaced, Cowart said.

“My mother doesn’t understand why she can’t go home,” Cowart said. “Only at a basic human level, nobody has told us what we are supposed to do.”

Allstate was not available to comment on Monday.

Rob Rhatt, insurance analyst for the loan tree, said it is “frustrating and not surprising” that insurance companies take to handle claims of smoke damage. Unlike fire damage, which is structural and clearly visible, the damage caused by invisible smoke does not fall perfectly into most categories. It requires professional evidence, cleaning and restoration with expensive external sellers.

In a nutshell, houses in high -risk forest fire areas are bad for business.

“These catastrophic losses have really reduced their profitability,” Rhatt said about insurance companies. “It’s not just reducing their profitability where they are earning less money, but in reality threatens their solvency to the point that they are losing money ensuring houses in California.”

The resident of Pacific Palisades, Ian Hardcastle, said he never had the option of completely securing the 2,600 square feet house that he shared with his wife and 14 month old near the Temezal State Park, where he caused the fire of Palisades.

After buying his home in 2021, he enrolled in the California fair plan, which provides coverage for those who cannot obtain private companies insurance, and expected any forest fire to remain hidden in the mountains and cannons, as they had historically done.

But on January 7, a hell driven by the wind crossed the state park behind his house and devastated the surrounding neighborhood. His home was overwhelmed by the undulating smoke and toxic ashes for several days. Hardcastle can be inside just a few minutes at the same time.

His adjuster cited $ 1,826 for remediation, but a deductible $ 5,000 means that Hardcastle will not receive any payment for the work that can cost much more.

“This, this little plot of land was our happy and happy place, so we are happy that it is still here,” said Hardcastle on Thursday while traveling his property. “We want to return, but again, we don’t know when that will be.”