Multiple lawyers interviewed by NBC News reviewed the loan agreement that Mazzola’s practice signed and characterized it as an adhesion contract, in which one of the parties calls the shots and the other has few options to agree. The financial ruin that Mazzola and other doctors faced due to hack, an event caused by inadequate security in Change Healthcare, made the loans even more unilateral, some lawyers said. As a result, doctors can have a legal resource after aggressive actions that United Group took to extract loan payments.

The central question that surrounds the reimbursement actions of the UnitedHealth group is “if they abused their use of this remedy by insisting on reimbursement before it was appropriate that they did the damage they caused,” said Daniel Schwarcz, professor at the Law Faculty of the University of Minnesota, in an email.

Amid his clashes with doctors, United Group announced profits of $ 9 billion of operations in the first quarter of 2025, a 15% jump since the same period last year. The income for three months was $ 110 billion.

Even after the change in medical care restarted the prosecution of claims, the doctors who spoke with NBC News said they were never reimbursed by many statements because the interruption meant that they could not present them within the required periods of time of the insurers. Doctors also said their costs increased after hack because they had to pay staff members to pursue reimbursements.

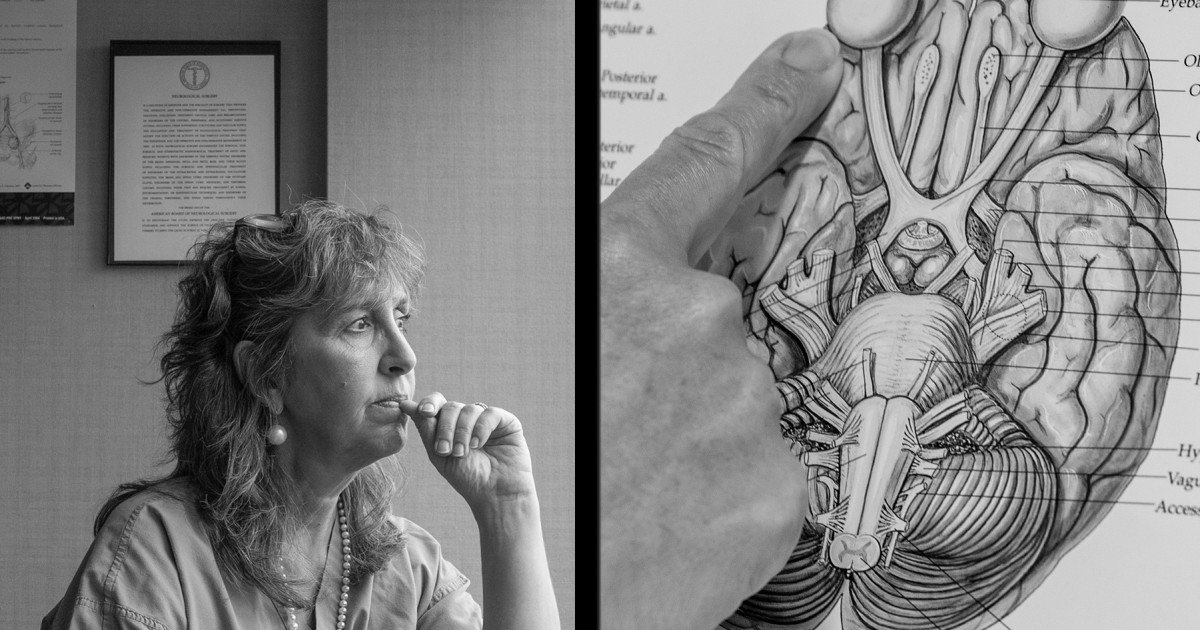

Mazzola, who estimates that his practice lost $ 1 million due to the trick, has asked Optum to reimburse the costs for the costs that his practice incurred as a result of the rape. But the terms that Optum offered would have forbidden to sue it due to the trick. Then she refused to accept it.

“I really believed that Optum, who was orchestrating these loans, would give doctors and medical groups a reasonable amount of time to pay loans with the understanding that this financial crisis almost bankrupt us,” Mazzola said. “I mean, literally, you are talking about $ 0 in your bank account, and you have 70 employees to pay.”

Patient care delaysDoctors say they were not the only ones hurt by hack. Patients also suffered damage when suppliers did not have the reimbursement income necessary to buy medicine, for example.

“There were many delays in patient care as a result,” said Dr. Pruvi Parikh, allergist and immunologist in New York City, who is a medical director of a practice with six locations in New York and 15 in New Jersey.

The Parikh group borrowed $ 400,000 from Optum to survive hack. At the end of 2024, he had paid all except $ 102,000, according to the documents.

On January 7, Optum threatened to retain reimbursements to the practice of Parikh if the rest of the loan was not paid in days, it shows an email.

“Developing that amount of money in five business days is not possible for most private practices,” Parikh said in an interview. “Not only did they not give us time to stand up, but they told us: ‘Paging now'”.

While the practice met the demand for Optum, he estimated that it is $ 2 million due to the trick.

In a statement, Change Healthcare said he began to recover funds that he had provided “more than a year after the event and with the restored services.” The company said it is reaching those who “have not responded to previous calls or email applications for more information.”

The main reason why doctors such as Parikh and Mazzola are in this melting, say antimonopoly experts and doctors, is that United Group operates so many gears in the nation’s medical care machinery. By acquiring a variety of medical care operations in recent years, including medical practices and the benefits of pharmacy, management, technology, claims processing and financial services, UnitedHealth Group can exert market muscle on weaker participants such as doctors and patients.