The Bank of Canada has reduced its loan rate during the night by 25 basic points to 2.75 percent, announced Wednesday, since an ongoing commercial war with the United States begins to tighten the Canadian economy.

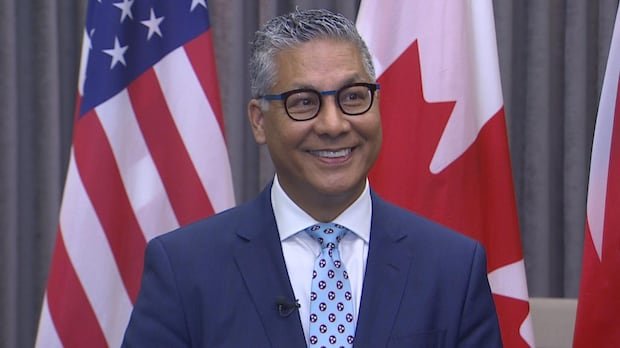

By explaining the decision in his opening comments, the governor of the Bank of Canada, Tiff Macklem, said the economy began the strong year, with a solid growth of GDP and inflation within its two percent target.

But the tariff uncertainty caused by the commercial war out again, out again between Canada and the United States, has weighed commercial expense and hiring, and the confidence of shaking consumers, he said. Manufacturing companies in particular have reduced their sales prospects.

It is “in this context” that the Central Bank decided to reduce the rate by a point, according to Macklem, although he added that an increase in exports before the rates could compensate for a deceleration in growth.

“While it is still too early to see a lot of impact of the new tariffs on economic activity, our surveys suggest that the threats of new rates and uncertainty about the commercial relationship of Canada-United States are already having a great impact on business and consumers intentions,” he said during his press conference on Wednesday.

The governor of the Bank of Canada, Tiff Macklem, who reduced the bank’s key interest rate on Wednesday to 2.75 percent, says that the commercial conflict with the US can be expected.

It is the seventh consecutive cut that the bank has made since it began to reduce rates in June 2024.

“They are clearly concerned that an economy that otherwise be in quite a good shape and that there would be no need for a feature cut now needs this, and perhaps more, given the possible shock of the highest rates and what will do to the Canadian economy in the short term,” Avery Shenfeld, CIBC chief economist, said.

RBC, Scotiabak, Cibc, TD Bank, BMO and National Bank reduced their primary rates at 25 basic points from 3:50 pm et.

‘Now we face a new crisis’

Bank’s internal research shows that Canadian companies intend to increase prices to compensate for the impact of tariffs. As Macklem pointed out, less expense of companies and consumers tends to press inflation. But the increase in costs could trigger it.

“Now we face a new crisis. Depending on the extension and duration of the new US tariffs, the economic impact could be severe. Uncertainty alone is already causing damage,” he said on Wednesday.

Macklem has warned in the past that the bank cannot protect the Canadian economy from the financial impact of tariffs, but can use interest rates to manage a potential increase in inflation.

The governor of the Bank of Canada, Tiff Macklem, who reduced the bank’s key interest rate on Wednesday, said the bank expects tariffs to affect inflation in several ways, including changes in export markets and supply chains, as well as to change national consumption and saving habits.

Meanwhile, the preferred inflation measures of the bank’s centrals are still above two percent, mainly driven by the growth of housing prices, which adds to their concerns.

When asked what kind of inflationary impacts that Canada faces, Macklem said during the questions and answers with journalists who “given the generalized uncertainty and the unpredictability of US commercial policy, I cannot put a number on it.”

Several factors could contribute to inflation, he said. The weak Canadian dollar raises a challenge for importers, because it means that the products they bring will be more expensive; The retaliation rates imposed by Canada will also add costs; And the uncertainty itself adds costs, because companies seek new suppliers and new markets to sustain themselves.

“Someone has to pay for these costs and, ultimately, they happen to the consumer,” he explained. “What we can do is make sure that any increase in inflation is temporary.”

Avoid the word recession

As a journalist pointed out, Macklem never used the word recession in his comments, what some economists have said that it is a probable result since tariffs will hinder growth.

As for whether a recession is imminent, Vice Governor Carolyn Rogers said the bank does not have a prognosis at this time. “All those things are not a good omen for growth, but we’ll see,” he said.

The next meeting of interest rates of the Bank of Canada is April 16, at which time it will also publish its quarterly monetary policy report to evaluate the perspectives of the Canadian economy.

The chief economist of BMO, Douglas Porter, wrote in a note to the clients that any future interest rate “will be largely guided by the direction of travel in the commercial war, although we suspect that the bank was going a little lower in any case.”

“Our central assumption is that Canada will face some serious tariffs for a prolonged period of time and that the business cushioning aspects of the commercial war will finally exceed the inflationary impact on the rise, keeping the bank in mode of flexibility,” Porter wrote.

He expects the bank to make a 25 basic points cut in each of his next three meetings, which carries the loan rate at night to two percent.