The Conservatives are calling on the government to stop collecting capital gains taxes at the increased inclusion rate the Liberals proposed as part of last year’s budget.

Conservative finance critic Jasraj Singh Hallan argued that the higher inclusion rate should not apply because Parliament never officially passed it into law.

“They are taking money from small businesses without the consent of Parliament and have created a tax filing nightmare for Canadian workers across our country,” Singh Hallan wrote in a letter sent Tuesday to Finance Minister Dominic LeBlanc.

“As Finance Minister, you have a responsibility to stop this job-killing tax rise before it causes even more damage to our economy. If you refuse to do this, then at the very least you should order the Revenue of Canada to stop collecting this tax until after an election.”

Singh Hallan signed the letter along with Adam Chambers, the Conservative national income critic.

The federal budget in April announced an increase in the “inclusion rate” taxable on capital gains – the profits individuals or companies make when selling an asset such as a stock or a second home.

The new rules increased the inclusion rate from half to two-thirds for capital gains over $250,000 for individuals and for all capital gains earned by corporations and trusts.

Legislation to officially introduce the capital gains changes was before the House of Commons, but is now essentially dead after Prime Minister Justin Trudeau called for Parliament to be prorogued.

But the Canada Revenue Agency is still collecting the tax on the inclusion rate increase, because the government passed a “ways and means” motion in Parliament.

“Parliamentary convention dictates that tax proposals are effective as soon as the government files a notice of ways and means motion; this approach provides consistency and fairness in the treatment of all taxpayers,” the Department of Finance said in a statement to CBC News last week. .

The Liberals have argued that less than one per cent of Canadians are affected by the inclusion rate increase, but others have disputed those figures.

Economist Jack Mintz has estimated that up to 1.26 million Canadians would pay the higher rate at some point.

Business groups have been denouncing the rising inclusion rate.

The Canadian Chamber of Commerce agreed that the government should not collect the tax based on the ways and means motion.

“It is inappropriate, and in our analysis, unprecedented, for a government to continue to implement fiscal change based solely on a ways and means motion, with the clear threat of a no-confidence motion and without a clear timetable for introducing the legislation,” Jessica Brandon-Jepp, senior director of the chamber of commerce, said in a statement.

“Given the likely possibility that this tax increase will no longer be enacted in 2025, it is imperative that the government provide certainty to Canadians and direct the CRA not to implement this measure until after an election, if at all.”

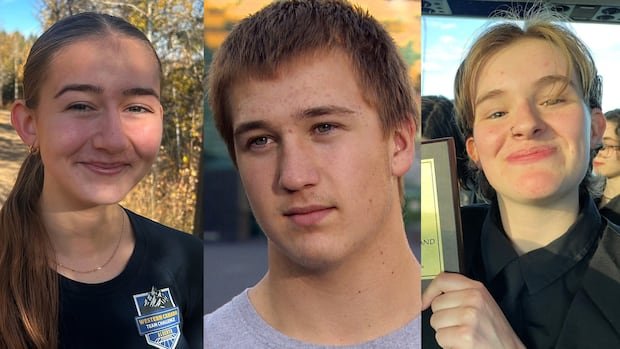

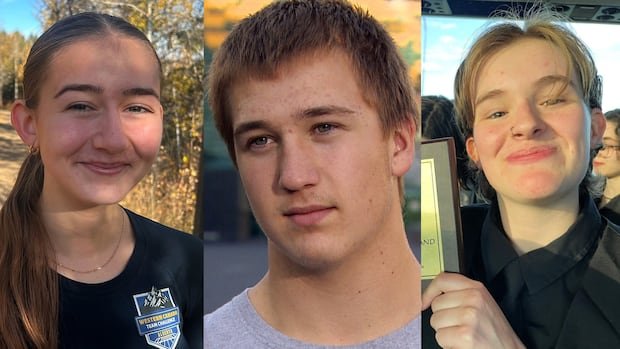

Canada’s capital gains tax increase will come into effect on June 25. Andrew Chang looks at some misleading claims about the changes coming from both sides of the political aisle and explains who will likely pay the new tax, how much and how often. Does it really only affect the ultra-rich?

Dan Kelly, president of the Canadian Federation of Independent Business, argued on social media last week that the lack of certainty about the future of the inclusion rate is a problem.

“I hope that small business owners and Canadians with capital gains will not have clarity for a year or more. This is deeply unfair and disrespectful to Canadians who have important transactions ahead of them,” he wrote.

The Department of Finance says the only real way to get back to that original inclusion rate is to wait for the next session of Parliament.

“Upon the resumption of Parliament, if no Bill is passed in the House of Commons and the government signals its intention not to proceed with the proposed measures, the CRA would cease to administer them,” the department said.

NDP national revenue critic Niki Ashton said tax changes should go ahead to help fund federal services, but blamed the Liberals for creating uncertainty.

“By choosing to prorogue Parliament and prioritize a leadership race, the Liberals questioned the implementation of this tax increase. In doing so, the Liberals placed the interests of their party above the well-being of Canadian workers,” he said in a release.