A judicial battle on the heritage of $ 275 million of the late singer Jimmy Buffett has highlighted the growing litigation of the billion dollars in wealth that are transmitted to spouses and families, experts said.

The widow of Jimmy Buffett, Jane Buffett, presented a petition last week in a Los Angeles court to eliminate her co-fomestant, Richard Mozenter, of The Marital Trust created to support her after the singer’s death in 2023. Jane buffet, who married Jimmy in 1977, claimed that Mozenter has been “openly Hostile and adversary “towards her and has recast to her details. She claimed that Mozenter is raising “excessive rates” of $ 1.7 million a year and that it is wrong to administer fiduciary assets, projecting revenues of only $ 2 million, which implies annual yields of less than 1%.

Mozenter has filed his own demand in Palm Beach County, Florida, claiming that Jane has been “completely not cooperative” in his efforts to manage trust. He said that Jane has interfered in commercial decisions, refused to meet with Mozenter and violated her fiduciary duties to “act in his own interest.”

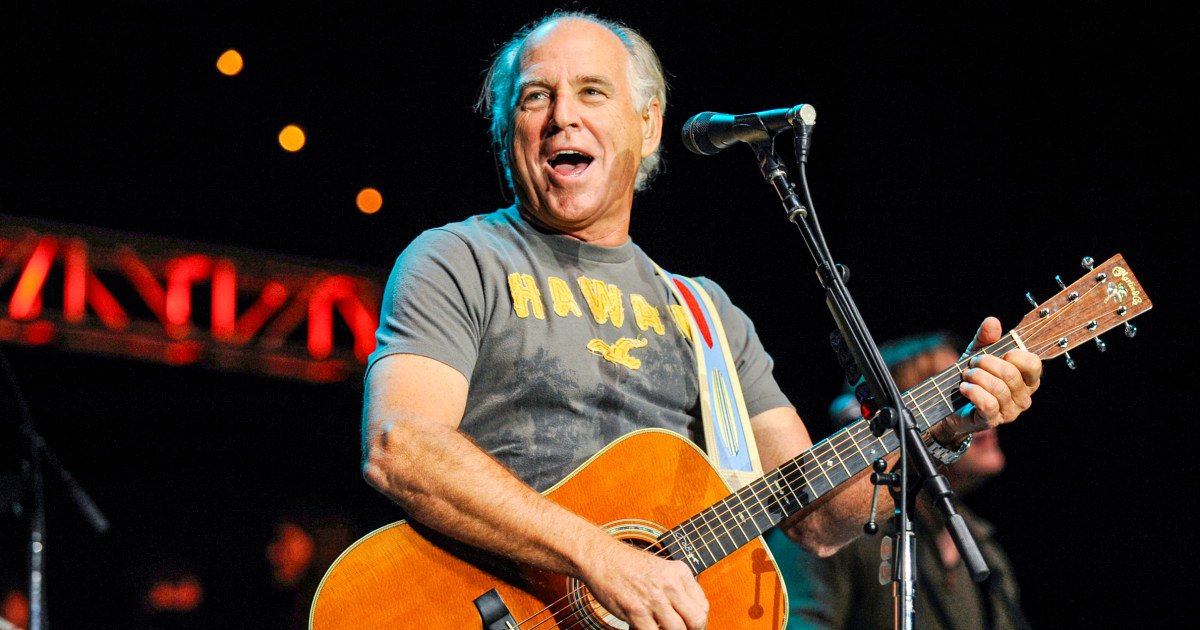

The case has highlighted the patrimonial plans and the commercial empire left by Jimmy Buffett, the singer famous for successes such as “Margaritaville”, “Hamburger with cheese in paradise” and other successes and vibrant successes of the beach. Together with its song catalog, Buffett left houses, cars, airplanes and a multimillion -dollar participation in its brand business.

Buffett carefully planned for the hereafter. His will, for the first time written more than 30 years ago and amended in 2017 and again in 2023, directed that most of his assets are placed in a marriage confidence for Jane. The trust was created “for the only benefit of the wife of his life,” according to legal presentations. The three children who shared, Savannah, Delaney and Cameron, are the so -called remaining beneficiaries of the conjugal trust, which means that they will receive any remaining asset that remains after Jane’s death.

Jimmy Buffett also requested a co-juggage to manage trust with Jane. He appointed Mozenter, an accountant who had also been his commercial manager and financial advisors for 30 years, such as CO-E-Trustee.

The assets that went to buffet were substantial. A successful businessman and businessman, Buffett built a brand’s empire and marketing business that far exceeded his songs of songs and tours. According to the presentations, assets in the heritage included $ 34.5 million of real estate; $ 15 million in a company called Strang Bird Inc., which had Buffett’s interest in several planes; $ 2 million in musical teams; $ 5 million in vehicles; and $ 12 million in other investments.

One of the biggest assets is Buffett’s participation in Margaritaville, the restaurant chain, bars, hotels and merchandising that commercialized Buffet’s lifestyle. According to the presentations, Buffett’s heritage in Margaritaville was estimated at $ 85 million, maintained through JB Beta. Margaritaville currently has 30 restaurants and bars, 20 hotels and vacation clubs, casinos, cruises and goods.

Shortly after Jimmy’s death, however, the relationship between two sets of contracts was attributed. In his complaint, Jane Buffett said Mozenter refused to provide basic financial information about the trust. He “belittled, did not respect and condescended Mrs. Buffet” in response to his request for information, he said. She said her fees of $ 1.7 million a year to manage the trust were “huge.” When he requested his projected income from the trust, Mozenter continued to delay. Finally, after requesting the help of his friend Jeff Bewkes, Time Warner chief, Mozenter gives him an estimate of $ 2 million a year.

According to Jane’s complaint, Mozenter acknowledged that Margaritaville had paid $ 14 million distributions in the previous 18 months. However, he refused to make future projections. “According to that analysis, Mr. Mozenter told Mrs. Buffett that the income of the marital trust would not cover his annual expenses and informed him that he could” consider the adjustments, “according to his complaint.

Trust lawyers said the case is part of a growing wave of demands related to inheritances and trusts. It is expected that more than $ 100 billion of wealth will be transmitted from generations greater to spouses and families in the next 25 years, according to Cerulli Associates. More wealth is transmitted means more litigation, since families often fight who gets what.

Buffett’s case has reflected a different source of disputes, but equally common.: Duel Trusts. Heritage lawyers said Buffett could have made Jane the only beneficiary and the only administrator. However, he chose to have Mozenter as CO-E-Trustree to help manage and direct trust.

Mozenter said that during his life, Jimmy, “he repeatedly expressed his concerns regarding Jane’s ability to manage and control her assets” and was “very careful to create confidence in a way that prevented Jane from having the real control over trust.” He added: “This fact has angry Jane a lot.”

The lawyers said that designating a co-juggage is common. Sometimes, the heir is poorly equipped to handle wealth or asset. Sometimes they prefer to leave the details to another person. Whatever the reason, the tensions between the beneficiary and the co-juggate often explode in full-fledged hostility.

“These cases almost all have exactly the same problem,” said Keith A. Davidson, from Albertson and Davidson Llp. “You have a beneficiary who does not feel that they are obtaining enough information and does not feel that they have anything to say. And you have an administrator who is being too paternalistic, and feel they can give information about what they want. That is a recipe for disaster.”

Emotions are especially high when one of the trusts is a spouse.

“Imagine that he is married to Jimmy Buffett for 47 years, he has something to say about how he is spending his money and what he is doing and everything that disappears during the night,” said Stewart Albertson, also from Albertson & Davidson Llp.

Since the lawsuits were filed in different states, the courts will first have to decide where the case will be heard. After that, a judge will begin arguments and, ultimately, will decide a path to follow. The lawyers said the judges have generally put themselves on the side of the external administrator (in this case Mozenter). However, more and more, they have been on foot of spouses, which could mean that Mozenter is eliminated.

Most likely, lawyers said, a judge will determine that the relationship between Mozenter and Jane is unfeasible and appoints a new professional or corporate administrator of a fiduciary company or bank to replace them both.

“I suppose that a judge is likely to give someone like a professional fiduciary,” said Alex Weingten, managing partner of Willkie Far & Gallagher Llp at the Los Angeles office and president of his practice of entertainment litigation. “That would allow the trustee to enter and discover what is happening. It’s not what she wants, but she would give credit to her argument.”

The lawyers said that the $ 1.7 million Mozenter rate is not necessarily excessive, since administration rates can sometimes be as high as 1% or more of the assets every year. Regarding the return of $ 2 million a year at $ 275 million, as evil management, lawyers say that many of the assets in the trust, such as real estate, airplanes and cars, do not produce income and cost money to maintain. Therefore, the real yields of income producing assets could be higher.

Even so, lawyers said the Buffett case offers two important lessons for families that plan wealth transfers. First, they said that wealth holders should communicate the plans for their properties before dying so that no one is surprised. If Buffett had explained Trusustee’s roles to Jane and Mozenter, maybe the tensions would have minimized.

“Jimmy did a good planning, as he established these trust,” said Davidson. “But he didn’t think about how this was really going to play.” He could also have added a “right of elimination” in the trust to allow Jane to more easily eliminate Mozenter if she wishes.

The second lesson is that friends or business partners are not always good trust. While the rich of today often appoints a trusted friend for a family trustee, the administrator can have a different relationship with the beneficiary and can see themselves carrying out the desires of the descendant, which is not the work of an administrator.

“In terms of problematic cases, which we see rarely involve professional trust,” Albertson said. “It’s almost always someone who is a friend. That tends to be the worst. Your role is to follow the terms of trust.”