Analysts say that the number of GDP per capita is a bad indicator of the welfare of the average citizen; Pakistan needs more imports.

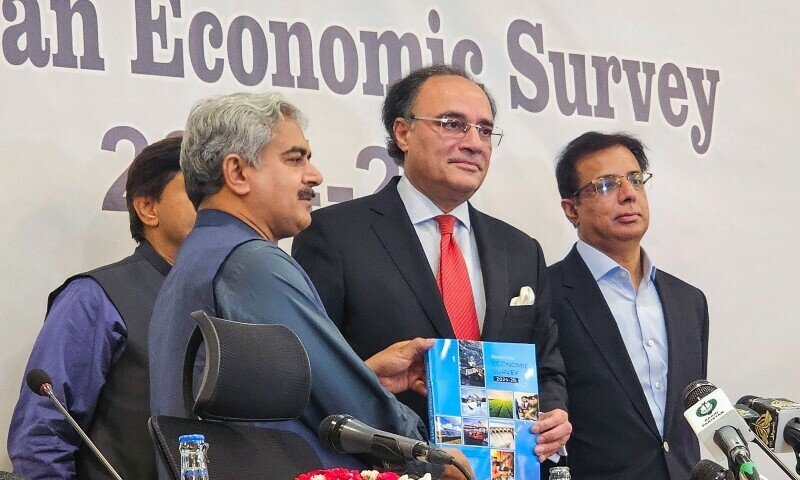

The Government published on Monday the economic survey of Pakistan 2024-25, revealing key figures for the fiscal year that ends in June. The key between them was the economy that expanded by 2.7 percent during the previous year.

Initially, the government had directed GDP growth (gross domestic product) to 3.6pc, but lowered it last month. The International Monetary Fund expects real GDP to grow in 2.6pc in fiscal year 2015 and that the economy grows 3.6pc in the fiscal year26.

In his prologue of the survey, a key document prior to the budget, the Minister of Finance, Muhammad Aurengzeb, said that Pakistan’s economy had been recognized worldwide for achieving macroeconomic stabilization in the outgoing fiscal year.

Pakistan constantly advances in an ascending trajectory, is based on friendly reforms with investment, greater national savings and greater direct foreign investment, with a growth of the GDP projected to 5.7pc in the medium term, he said.

Dawn.com He spoke with analysts about his opinion about the economic survey, particularly in relation to the four things: the growth rate of GDP, GDP per capita, the large -scale manufacturing deficit and Pakistan’s tax revenues to GDP.

This is what they had to say:

Weak demand, high energy costs that stagn the LSMS

The annual growth figure of 2.7PC reflects a strong growth rebound in the third quarter, which seems inconsistent with the previous quarterly trends, said Ali Ali Hasanain, associate professor of economy in LUMS. “Large -scale manufacturing has contracted, and agriculture is practically stationary, with continuous concerns about the precision of cattle growth numbers.”

He commented that the per capita number of GDP, expressed in the current USD, was a poor indicator of the welfare of the average citizen at a time when the dollar has remained in a narrow corridor since the late 2023. “Until the demand is standardized and trade grows, we must remain cautious when interpreting indicators expressed in terms of dollar.”

Speaking about the large -scale manufacturing deficit, he said he was fighting due to the weak domestic demand, import restrictions and high energy costs. “These are deep and structural problems. Pakistan needs reor

“Agriculture, retail trade and real estate remain undertaken. There has been some expression of commitment to rectify this, but the government has little substantial achievements to show in three years so far,” Hasanain added.

Pakistan needs more imports

According to economist Ammar Habib Khan, GDP growth levels were largely aligned with consensus. On the other hand, the growth of GDP per capita was largely due to the “stability of the rupee against the US dollar.”

Khan said that for large -scale manufacturing to grow, Pakistan needed more imports. “And for that, we need more dollars and more demand, which remains compressed.”

On taxes, the macroeconomist commented that the load was largely covered by salaried taxpayers, indirect taxes and formal industries only.

Lack of engines for growth

When commenting on the statistics presented in the economic survey, economist Adil Nakhoda said that the informed GDP growth rate is probably driven by the industry sector, which reported a growth of 4.77 percent. Interestingly, this was dominated by the use segment of use, which grew at 7.6pc. In addition to crops, the agricultural growth rate was quite limited, while large -scale manufacturing contracted in the fiscal year.

“Although the general growth rate itself is not very different from the number reported in the previous year, to 2.5 percent, the problem is the lack of motors for growth, since it has been limited in just a few sectors and industries. The greatest concern for the next fiscal year is the large -scale manufacturing index. Import restrictions and the lack of competitive pressure need to reduce themselves to revived industrial growth.”

When commenting on the growth of GDP per capita, he said he was quite surprising, since he put the same about 10 percent. “Although this is the highest since 2021-22, it has generally been higher than the calculation of the GDP growth rate. As this is adjusted by inflation, the decrease in inflation may have contributed to a higher number, since the GDP growth rate was similar.”

He pointed out that large -scale manufacturing had been affected not only by import limitations, but also because of the lack of competitive pressure in the industry, since several industries in Pakistan had enjoyed protection in terms of high rates and the inability to be globally competitive.

“This has particularly reduced its ability to produce goods and meet local demand. There must be a dynamic adjustment in the manufacturing sector if we want to wait for any growth in it, and that has to come with an increase in competitive pressure to ensure that the manufacturing sector produces goods that can compete not only at the regional but global level.”

In Pakistan’s tax revenues, Nakhoda said the two main sectors that needed to increase their contribution to taxes were agriculture and retail and wholesale trade.

“The agricultural sector has always enjoyed the fiscal exemptions that have made their contribution to tax revenues much lower than their contribution to GDP, while the retail and wholesale sector has often evaded the fiscal network. Its contribution must increase so that the load is not only shared equally, but also reduces the burden of other sectors that often contribute to a greater participation to the income of taxes that its contribution to GDP To other sectors.

Image of heading: Pakistan Finance Minister Muhammad Aurengzeb, shows a copy of the economic survey of fiscal year 2024-2025 during a press conference in Islamabad, Pakistan, June 9, 2025.-Reuters