The Pakistan Stock Exchange began to recover on Tuesday, since the actions won more than 1,700 points, one day after the index experienced losses.

The KSE-100 reference index increased by 1,734.69, or 1.51 percent, to stand at 116,644.17 since the last closure of 114,909.48 at 11:02 am

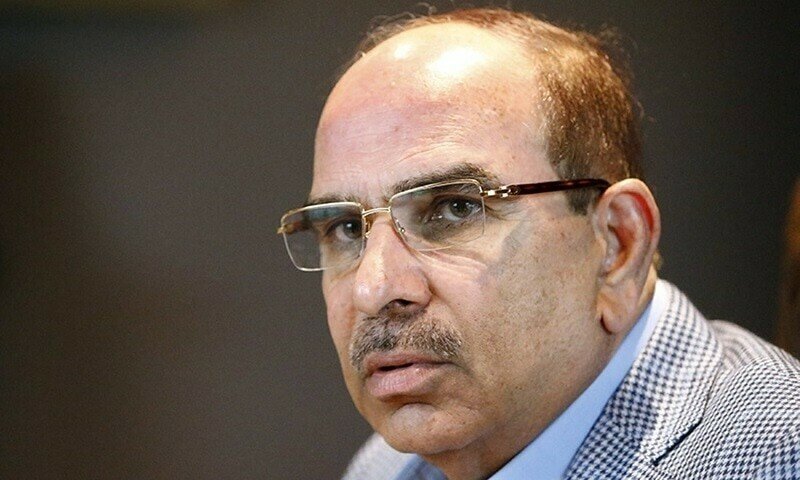

Yousuf M. Farooq, research director of Chase Securities, said: “The stock market has recovered yesterday as the Asian markets recover.

“In addition, the media report that the Minister of Foreign Affairs has contacted [US Secretary of State] Marco Rubio and that Pakistan has initiated discussions on rates are considered positive developments, ”he said.

He stressed that most participants believe that Pakistan “should remain relatively isolated from the impact of tariffs, since exports constitute a small portion of the economy.”

“In fact, lower basic products prices could boost national consumption,” he said.

According to FAROOQ, yesterday’s decrease resulted in an accumulated loss of RS474 billion.

However, he added that yesterday’s decline was “very normal” and that “companies this morning continue to do what they are doing.”

Awais Ashraf, Research Director at AKD Securities, said the market recovered “as investors took advantage of purchase opportunities, promoted by the recovery of Wall Street and the positive impulse in Asian markets.”

“In our opinion, yesterday’s decline was unjustified, especially taking into account the favorable implications for Pakistan in the middle of the current commercial war,” he said, adding that he believed that “recently tax tariffs offer a comparative advantage for Pakistan exports, given our relatively lower rate rates compared to the peers.”

“In addition, the prices of the softest basic products are expected to support the improvement in the country’s external account position,” he said.

Mohammed Sohail, executive director of Topline Securities, said that Pakistani actions had recovered “in line with recovery in US and global markets.”

Yesterday, the shares fell for 3,882 points in the middle of the agitation of the global market after China’s retaliation rates against the United States.

The trade was suspended early in the PSX for an hour after the reference index collapsed by 6,000 points that triggered the suspension, only to drop another 2,000 points when trade resumed.

The analyst had attributed the decline to “investor fears that tariff walks could lead to the global recession through a weaker demand.”

The rebound in Japan provides a respite for battered markets

Asian actions bouncing in more than a year of minimum and future US shares pointed on Tuesday, but many investors remained nervous even when they expected Washington to be willing to negotiate some of the aggressive rates that have unleashed agitation in the markets.

A 5.6pc rebound in Japan Nikkei far exceeded other regional markets, with Treasury secretary, Scott Besent, in charge of the main commercial negotiations with Tokyo.

“It is important to highlight that a small sun ray is beginning to arise that it gives the hope that the United States will be really open to commercial negotiations, (with) the most significant is Japan with Treasure Besent secretary,” said Tapas Strickland, head of the National Mercado Economy of the National Australia Bank.

Strickland, however, said that volatility remains extremely high, with the “rare event” of the Vix index that rises above 60 during the night for the second time from the pandemic.

In fact, the increase in Tokyo occurs after a strong sale of the sale in recent days, while China’s markets rose only modestly after the country’s sovereign wealth funds intervened to buy shares. Taiwan’s reference point dependent on Chip-Export fell 5pc, one day after suffering its worst recorded fall.

The broader MSCI index of Asia-Pacific shares added 1.7pc to climb from its lowest level since February 2024, but that followed an immersion of more than 10 percent in the two previous sessions, and much of the rebound came from Japanese actions.

Thai stocks fell almost 6 percent in the sale of a sale of a vacation on Monday, while Indonesia returned from a week vacation to losses of 9 %.

Hang Seng of Hong Kong rose 1.6pc after his most steep fall from the 1997 Asian financial crisis on Monday. The continental blue chips added 1pc, with the help of buying for the sovereign Fund Central Huijin Investment and other investors backed by the State.

The Chinese yuan fell to 7,3677 per dollar in the offshore market, the weakest in two months, before recovering to be a little stronger than Monday’s closure at 7,3393.

The greatest uncertainty in the markets was not helped by changing the owners in trade, since investors sought the respite of the acute market volatility.

An erroneous report of CNBC President Donald Trump was considering a 90 -day break about tariffs for countries other than China was quickly denied by the White House.

Trump also dug in the heels on China, promising additional taxes of 50 percent if Beijing does not remove retaliation rates in the United States. Beijing said Tuesday that he will never accept the “blackmail nature” of US tariff threats.

More to follow