Pakistan now faces a 29 percent tariff on its exports to the US, significantly higher than the 10PC baseline.

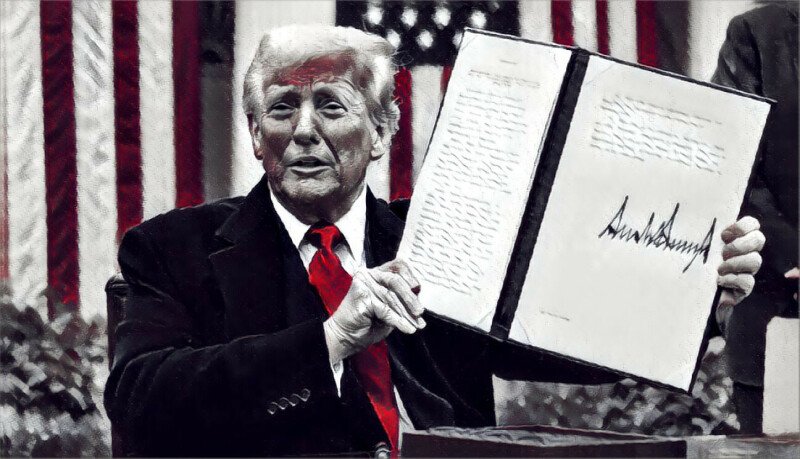

On Wednesday, President Donald Trump, in an attempt to give the United States “great power to negotiate”, imposed 10 percent tariffs on all countries, which take effect on April 5, lighting the fears of the highest price increases in the world’s largest consumer market.

In addition, individualized reciprocal sanctions will be imposed in several countries, as of April 9. These sanctions can increase tariffs at invisible levels from the end of World War II.

Tariff rates recently applied by the Trump administration have created a significant controversy, since experts around the world not only doubt the methodology of their application but also their purpose. It is widely believed that these sanctions are likely to trigger tariff wars that will not only be harmful to the United States but also for the world economy.

The United States is, with much, the largest importer in the world and the most important export destination for several of its commercial partners. These tariffs will have implications in the economic conditions of their commercial partners, since they will surely have difficulty providing products at competitive prices to US consumers.

Among these commercial partners is also Pakistan, who now faces a rate of 29 percent rates in their exports to the US. Islamabad exports to Washington are dominated by textile products, such as Pakistan’s other counterparts.

Break down

Tariff fees determined by the Trump administration represent two things: the commercial deficit between the US and their commercial partners and the level of imports that reach the United States of their commercial partners. Due to this, several countries that direct a commercial surplus with the US. They are being very penalized, while the countries with which the USA directs the rates of balanced commercial rates about 10 percent.

In essence, the purpose of these rates is to discourage commercial partners to execute a large commercial surplus and, instead, achieve a balance by complementing exports to the US. UU. With imports from it.

Conventionally, tariff rates in US imports have been lower than those imposed by commercial partners in US exports. Exporters face higher rates to export their US products. UU. In relation to their foreign counterparts that export their products to the United States. This is the argument presented by the Trump administration, since it promotes the highest tariffs in its commercial partners. However, retaliation rates are much higher than those imposed by their commercial partners.

The revised tariffs that were charged by the US. UU. They were calculated by determining the relationship of the commercial deficit with each commercial partner to the imports to the US. The higher the commercial deficit, given the level of imports to the United States of the commercial partner, the greater the rate charged to the United States. This method aims to account for non -tariff barriers that hinder trade for US exporters. Therefore, Pakistan, with a commercial balance of $ 3.3 billion in 2024 and exports to the USA worth $ 5.5 billion, faces a rate of approximately 60 percent. The Trump administration has ruled out this rate at 50 percent and imposed a reciprocal rate of approximately 30pc in Pakistan imports.

This policy considers that exports and imports are complementary; An increase in imports to the US of a commercial partner must accompany an increase in US exports to the commercial partner. The reciprocal rates in Figure 2 are significantly higher than the tariffs imposed on US exports. UU. By commercial partners in Figure 1.

Exports to the US of their respective commercial partners as a percentage participation in total exports are presented in Figure 3. More than a quarter of the total exports of Vietnam and Cambodia are intended for the US. UU., While this participation falls below 20 percent for the remaining four countries. However, the United States remains the main export destination of a single country for China, India and Pakistan. It is the second largest export destination for Bangladesh, after Germany.

Although textile products constitute the majority of exports of Pakistan and Bangladesh, the proportion of their textile exports to the US. In total textile exports it is limited compared to Vietnam and Cambodia. More than 40 % of Vietnam and Cambodia’s textile exports are intended for the United States. Therefore, it is likely that the textile exports of Vietnam and Cambodia in front of a greater impact of the reciprocal rates than their counterparts.

More than $ 9 billion of raw cotton from the United States was exported in 2022, which was approximately 30 percent of the total textile exports of the US. Execute a commercial surplus in the export of raw cotton. This is likely to believe a possible link between exports and imports in the textile industry, since political leaders around the world can implement measures to reduce commercial surplus with the United States.

According to the United Nations Riva Value Chain analyzer, an online tool for political leaders, analysts and researchers to better understand the integration of their economy into global value chains, approximately 18 percent of the Gross exports of the United States. UU. In the textile sector it is returned through exports of its commercial partners. This not only highlights the importance of participation in value chains, but also provides opportunities to negotiate tariff concessions with the US. UU. Depending on the level of its content used in the production of final products.

Pakistan was the second largest destination after China, with more than 15PC of total raw cotton exports in the United States for it. This was approximately 3pc in 2015. On the other hand, the proportion of Bangladesh and India has remained less than 10 percent.

Implications for Pakistan

As described above, it is likely that Pakistani exporters in front of significantly higher tariffs in their exports to the United States. However, it is likely that the impact of tariffs will be lower in relation to some of their counterparts in southern Asia and Oriental Asia.

After having been imposed with the purpose of reducing the bilateral trade deficit of the USA.

Therefore, it will be essential for Islamabad encouraging companies to participate in value chains that involve imports in the United States and turn these imports into exportable production for the United States and other countries. It is likely that the demand for imports from the United States will increase worldwide, since it is likely that other countries adopt strategies to reduce their commercial surplus with the United States. This will require strategies at the company level that must improve their capacities and capacities for such imports to become exports instead of being used as inputs for domestic consumption.

In fact, this is a discouraging task, but that is necessary if Pakistan must achieve its export objectives as provided in the recent economic transformation plans.