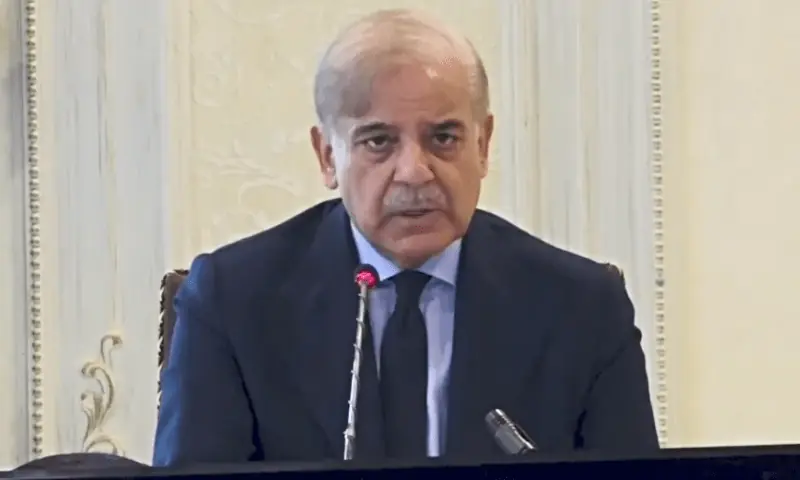

On December 18, Prime Minister Shehbaz Sharif’s cash-strapped government tabled the Tax Laws (Amendment) Bill, 2024 in the National Assembly, proposing sweeping changes to existing income and tax laws. sales aimed at tightening the noose around tax evaders: individuals and both companies, by making it difficult for them to spend their illicit money.

This is the most important action that the government is apparently taking to punish tax evaders, improve compliance and enforcement of the law to ensure that everyone pays taxes according to their level of income and consumption, as well as to complete the value chain of companies to dramatically raise the nation’s income level. a low tax-to-GDP ratio of less than 10 percent to 13 percent over the next three years to meet one of the central objectives of the ongoing $7 billion IMF bailout loan. Its immediate objective is to achieve the fiscal target of nearly Rs 13 trillion for the current fiscal year, which the FBR is struggling to keep pace with due to a collection shortfall of around Rs 350 billion in the first five months to November. .

The bill proposes empowering tax authorities to seal business premises and seize property and bank accounts of individuals and businesses that do not comply with taxes, in addition to suggesting several punitive restrictions on spending by people who are not active taxpayers or do not file returns. of taxes on all this on the purchase of real estate and automobiles beyond a certain threshold to be determined by the FBR. Furthermore, it imposes similar restrictions on investment in stocks, etc. by tax evaders, in addition to prohibiting them from maintaining or opening bank accounts.

Other notable features of the bill include allowing tax collectors to recover financial data of tax evaders from banks where their tax data and other financial information available with the FBR differs from their transactions through bank channels or accounts. Active taxpayers defined as “eligible persons” in the bill will be exempt from these restrictions as long as their expenses and investments match their income or financial resources declared in their property declaration. Your immediate family members who do not file tax returns will also be considered eligible individuals and will not be subject to the proposed restrictions.

Dr. Ikramul Haq, a prominent author and tax law expert, argues that the bill is self-contradictory as it does not abolish the income tax withholding and advance regime introduced to punish non-filers with a higher than normal tax rate and force them to pay. become tax filers. “The FBR wants to maintain these punitive indirect income taxes due to the significantly high revenue they generate and ease of collection.” That’s not all.

Considers that the measures proposed in the bill clearly violate the fundamental right to purchase and dispose of an asset and the freedom to do commerce and business enshrined in the Constitution. “It is worth mentioning here that a similar condition laid down in the Finance Act, 2018 prohibiting ‘non-filers’ (both residents and non-residents) from purchasing immovable property exceeding Rs 5 crore was later withdrawn as it was anti-business and violates the Constitution,” he maintains. “Imposing restrictions on economic transactions will harm the business environment and discourage new investment.”

Successive governments have failed miserably to fix the country’s inequitable, inefficient and corrupt tax system, which leaves entire sectors of the economy like urban property, retail, agriculture, etc. out of the net due to its power. political or agitation at the cost of worsening public service delivery and decreased resources for development projects critical to future economic growth. Only a fraction of the population files their tax returns, as the ineffective system has neither the capacity nor the will to pursue criminals.

Consequently, the State is disproportionately taxing the salaried classes, obedient organized companies, consumption and imports to reap easy money. The shortcomings of the system and the lack of political will to broaden the tax base became all too evident in the current year’s budget, when the authorities exponentially increased taxes on the income of salaried individuals and the corporate sector, leaving the powerful lobby free of responsibility. Still, it hasn’t been able to meet revenue targets. For example, a media report suggests that additional tax measures worth Rp 1.4 trillion introduced in the budget have not generated the expected revenue. So far, the FBR has collected only Rs 143 billion as against Rs 491 billion targeted by the new fiscal policy measures during the first five months of FY25.

Many insist that the sweeping changes in the country’s tax policy suggested by the FBR through the Tax Amendment Bill are unlikely to yield the desired results without deep reforms to increase the use of technology and make the system equitable, fair and transparent by taxing everyone. regardless of their source of income or their political influence and agitation power. At best, experts insist, it will give more discretionary powers to corrupt FBR officials to harass and coerce individuals and companies without any discernible impact on the tax-to-GDP ratio. In the worst case scenario, we could see Pakistan’s structural economic imbalances worsen in the future, fueling challenges such as low exports and investments, and the informality of the economy due to coercion in the name of compliance and law enforcement. , a greater tax burden on people who comply and political uncertainty.