An IMF delegation is in Islamabad to evaluate progress in the ongoing financing program of $ 7 billion of the fund in the middle of the hope that the review does not find any serious obstacles that can delay the next section.

The mission will evaluate how Pakistan has performed on the quantitative performance criteria, the structural reference points and the indicative objectives for the first half of the current fiscal year. There have been some “technical landslides”, such as delays in compliance with the deadlines of certain objectives, such as agricultural tax legislation.

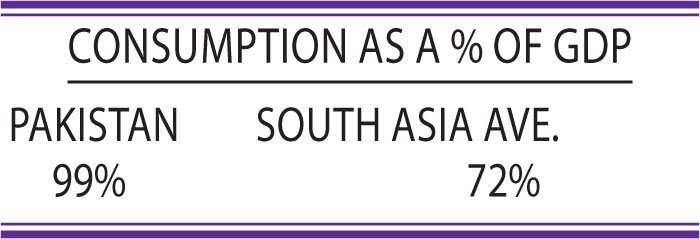

The officials insist that they have covered all the bases, although the lack of fulfillment of the fiscal objective will probably continue to be an important source of concern. However, officials are confident that the IMF will ignore the landslides in the fiscal objective due to a “higher GDP revenue ratio than aimed at what was directed.”

The FBR attributes the deficit largely to the reduction of import tax collection, LSM slow growth and an unexpected fall in inflation. The IMF’s response to the fiscal deficit remains to be seen. However, the decrease in the stock market betrays investors’ anxiety due to anticipated contingency measures under the pressure of the fund to achieve the real fiscal objective.

Despite the anxiety of investors, it is more likely that the IMF’s performance on Pakistan’s performance progresses without problems without any hard and hard condition for the second half of the current fiscal year, or punitive demands of the lender for tax landslides. That said, the current review will be critical to determine how the economy progresses.

In its success depends on the strengthening of economic stability, the official flows of other multilateral agencies and the improvement of sovereign credit rating, which is crucial for Islamabad plans to raise funds from international bond markets. Any hypo in the program pays these plans and would lead to a new wave of uncertainty and volatility.

For now, macroeconomic indicators suggest a temporary respite: the rupee has remained constant, inflation has joined 1.4pc, the current account is executing a surplus of more than $ 600 million, remittances have increased to more than $ 3 billion per month and exports show resistance.

These improvements are mainly due to the financial support of bif and bilateral lenders, as well as stability in world markets of basic products. However, the price of this fragile stability has been enormous: a strong deceleration in domestic growth, as well as the increase in unemployment and poverty.

With Trump’s second presidency in the United States, shaking the global economic and political order, the need to free the economy of the Status Quo forces and restructure it to stand up again has never been so convincing. The current IMF rescue could be the last chance to avoid a repetition of the past.

Posted in Dawn, March 4, 2025