There are some federal policy changes that could affect Canadians’ finances in the new year.

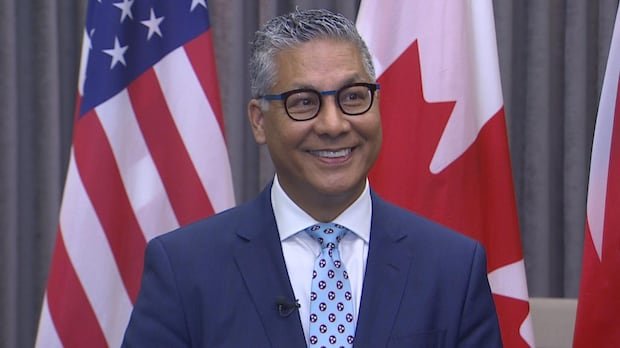

Brian Quinlan, a chartered accountant at Allay LLP, says many of the changes are routine. These include adjustments based on inflation in the tax bracket you are in.

Other changes, such as capital gains tax changes that will be in effect for their first full year in 2025, may require more planning.

Here is a list of changes to keep in mind:

tax brackets

By 2025, income tax brackets will increase by 2.7 per cent in the new year to prevent higher prices from pushing Canadians into higher tax brackets. This comes after a 4.7 percent increase in 2024.

For 2025, the federal tax is 15 percent for income up to $57,375; 20.5% between $57,375.01 and $114,750; and 26 percent between $114,750.01 and $177,882.

The tax rate is 29 percent for earnings between $177,882.01 and $253,414, while anything over that figure is taxed at 33 percent.

“You don’t pay more taxes simply because of inflation, so (the adjustment) is good news for all of us,” Quinlan said.

“Even if you have exactly the same amount of income in 2024 as you did in 2023, you will pay less taxes because less is taxed at a higher rate,” he added.

Basic personal amount

For tax year 2025, the basic personal amount, on which you pay no federal income taxes, ranges from $14,538 to $16,129, depending on your overall income.

That’s up from the 2024 figures, which range from $14,256 to $15,705. Those with lower incomes have a higher basic personal tax credit.

Canada Pension Plan

Some Canadian workers will have a little more taken out of their paychecks due to the increased CPP contribution amount.

A multi-year pension renewal began in 2019, when both the Quebec Pension Plan and the CPP began to gradually introduce enhanced benefits aimed at providing greater financial support to retirees. Individual contributions, and the employer match, increased as the plan was implemented.

Starting in 2024, there are now two additional earnings caps beyond the base level, and higher-earning workers will pay an additional premium on earnings within a second tier before reaching the maximum.

The income limit for first-tier earners will increase to $71,300 in the new year from $68,500 in 2024. The second income limit will increase to $81,200 from $73,200 in 2024.

After 2025, the program will have been fully implemented and the base, first and second tier limits will increase in line with wage growth rather than the larger jumps seen in recent years.

Anyone who worked and contributed to the CPP starting in 2019 is eligible to receive a higher CPP payment upon retirement based on earnings from that period.

Capital gains tax

There is some uncertainty here as the legislation has not yet been passed, but the proposed changes to the capital gains tax are significant.

Quinlan said the changes require “serious thought” for people considering selling assets in the new year, as it should be the first full year in which a higher tax rate for gains over $250,000 is in effect.

Timing the sale of assets is important, Quinlan said.

“As opposed to selling assets at a huge $300,000 profit in one year, you may want to sell some in one year and some in the next year,” he said.

Once they take effect, the changes will apply to any capital gains on or after June 24, 2024.

Under the new rules, a larger portion of an individual’s capital gains (the gains made from the sale of assets) are considered taxable.

Previously, the government taxed 50 percent of capital gains. While that amount represents capital gains of up to $250,000, it will be increased to two-thirds for gains over $250,000.

Registered retirement savings plans

For tax year 2024, Canadians can contribute to their registered retirement savings accounts until March 3.

The recorded retirement savings threshold will increase to $32,490 in the new year, from $31,560 previously, plus any contribution margin from previous years.

You can find the amount of your unused contribution room in last year’s notice of assessment from the Canada Revenue Agency or in your CRA online account.

This report by The Canadian Press was first published Jan. 1, 2025.