In the corner of High Park Avenue and Annette Street in Toronto, a church scheduled to transform into condominiums has been full for several years.

The construction of the 70 -units condominium project began in 2019, but there has been no progress since 2023.

“We all knew that something was wrong because it would only drive and that nobody is working, right? Nothing is happening,” said Phil Earnshaw, who paid a tank of $ 280,000 in 2018 for a two bedroom unit.

The project went bankrupt last year and sold this developer this summer. It means that buyers, such as Earnshaw, who paid deposits by units before construction began, will not get those units after everything and are now waiting to recover their deposits.

The stagnant development of High Park is just an example of a series of condominium projects throughout Toronto that have been canceled or admitted to a judicial administrator, and the number is expected to grow.

A report by the Canada Mortgage and Housing Corporation (CMHC) this week highlights a continuous fall in the construction of condominiums in Toronto. Meanwhile, the Real Estate Consulting firm Urbanation has tracked nine projects canceled in the city so far this year. That is on its way to complying with the total of 11 projects canceled last year, or 2,581 units, and Urbanation expects the trend to grow in the next quarter, since many projects fight with sales.

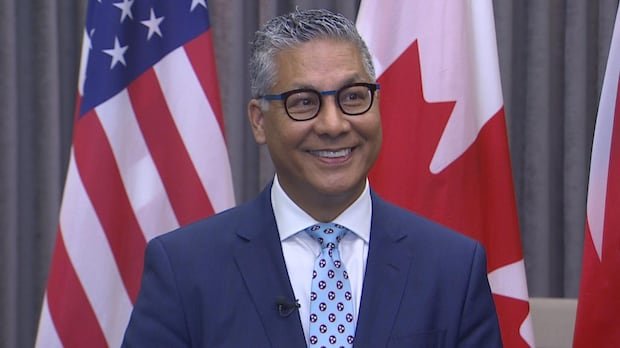

The condominium market in two of the big cities of Canada has taken a great deceleration. Nisha patel of CBC breaks down three reasons why condominiums are not sold in the midst of a housing crisis.

Toronto condominium begins to plummet

According to Urbanation, the previous peaks in the number of canceled condominium projects were in 2021, when 2,153 units were canceled, and in 2017, when 1,809 units were canceled.

The reasons for the canceled projects have changed, according to Michael Niezgoda, senior research and market development manager of the company.

He says that those previous peaks had to do with individual developers who face financial difficulties, “while what we are seeing today is more a broader market where [there is] Basically, the absence of buyers in the markets, the increase in costs. “

This week’s CMHC report highlights that the condominium begins in Toronto “collapsed” in the first half of this year and is the largest taxpayer to the general fall in homes, which reached its lowest point since 2009.

In general, 70 percent of the units must be previously sold to construction so that developers ensure financing. According to Niezgoda, Urbanation is currently tracking 16 projects, with a total of 5,045 units, in Toronto that launched more than a year ago that has sold less than 40 percent of the units. That is partly why Urbanation predicts that the number of canceled projects will continue to grow.

According to the CMHC report, investors have been some of the main buyers of condominium units prior to construction in recent years, but now they are increasingly moving away from them due to the decrease in profitability.

When Earnshaw and his wife signed a purchase agreement in 2018 for the unit in 260 High Park Ave., they considered renting it until they were ready to reduce size.

“Everything has changed since then and mathematics no longer work at all,” said Earnshaw, “so we are very happy to recover our money.”

Some buyers can welcome canceled projects

Earnshaw may not be alone among buyers prior to construction for whom a canceled project is not all bad.

Some who bought in a hot real estate market a few years ago can now find that the units no longer worth what they expected.

The real estate lawyer Bob Aaron says that he receives calls several times a week of people who face that scenario.

“For the contracts that were signed during and after Covid, the values have dropped and buyers should be very happy to get out of the treatment [if a project is cancelled,] Because they will not have to pay the high prices they signed during Covid. “

Aaron says that he hopes that the sales of condominiums prior to construction remain slow over the next few years. Although he points out that he will not last forever.

“The markets go up, the markets fall, and sooner or later the condominiums will be hot in the market.”